uk dividend withholding tax non resident

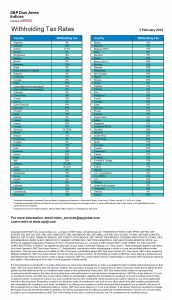

Ive talked more about that here, but UK Landlord Tax would be a safe place to start. That said, its worth pointing out a few things about other types of funds and shares in general. For banks and other financial institutions (excluding asset management companies (SGRs) and brokerage companies (SIMs)), the corporate tax rate is 27.5%. You can find all the latest information directly, If large amounts of tax are at stake it may be worth getting some, If youve made any money in the UK dont forget to submit a self assessment tax return. A form P85 should be filed to inform HMRC that you are leaving the UK. Yes, I would definitely recommend Experts for Expats, I was very impressed with the consultation, what really stood out was the consultants in-depth knowledge, his friendliness and the clarity of the information he provided (he scored 10 out of 10, in my book). You can find them here. Foreign dividend-paying stocks can increase a portfolio's diversification and provide exposure to faster-growing emerging economies. Continue completing the tax calculation summary notes to box A343. Yields of 4% to 5% are now available across fixed income securities such as Treasuries, corporate debt, certificates of deposit, an Warren Buffetts investment advice is timeless. Yes, the UK has a special tax regime for Non-Resident Landlords and this is maintained by HMRC by passing responsibility for the collection of withholding tax over to property management companies and your tenants. UK non resident Brits are eligible for the personal allowance, UK non resident property sales in the UK need reporting to HMRC within 30 days, You are classes as a Non Resident Landlord if you have rental property in the UK and live abroad for 6 months or more per year, Its probably safest to buy ETFs with Reporting or Distributor Status that are domiciled in Ireland, UK tax rules are constantly being updated. In other words, if you want to take a credit for some of your withholdings, than you need to take a credit for all of it, and vice versa. We have lost track of the number of investing mistakes we have made over the years, but almost all Thousands of dividend investors trust our online tools and research to track their portfolios, avoid dividend cuts, and achieve lasting financial freedom. Andersen LLP is the United Kingdom member firm of Andersen Global, a Swiss verein comprised of legally separate, independent member firms located throughout the world providing services under their own name or the brand "Andersen Tax" or "Andersen Tax & Legal," or "Andersen Legal." This helpsheet explains how income from UK savings and investments (such as interest or alternative finance receipts from banks or building societies, unit trusts, National Savings and Investments, or dividends from UK companies) is taxable if youre not resident in the UK for a tax year. ). Add box 5 to box 6 and enter the result in box 7. This exemption applies to qualifying temporary residents who are also Australian residents for tax purposes. Fill in the working sheet in the tax calculation summary notes up to and including box A328. Accordingly, 15% of the UK withholding tax may be claimed as a rebate against the 20% It is no longer as straight forward as ensuring you spend less than 90 days in the UK in order to avoid being UK tax resident. Every question weve ever received about UK Non Resident Investing has related to Exchange Traded Funds (ETFs), so this section is concentrated there. Under both scenarios, it is likely that a self-assessment tax return is required to correctly declare this income to HMRC. If the dividend paid is from a Non-UK source. As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. If you incorporate the personal allowance, this means that you will essentially pay 20% tax on your income between 12,570 and 50,270. You are classed as a Non Resident Landlord by HM Revenue and Customs (HMRC) if you have rental property in the UK and live abroad for 6 months or more per year. ETFs are taking over the investment industry due to their convenience, passive nature, tax efficiency and low fees. Meeting these deadlines avoids a minimum 100 fine and Im sure it goes without saying that HMRC has all kinds of options if you dont pay your tax. How will this change affect UK companies receiving relevant payments? These rates apply to all payees unless: the payment is made to a resident of a country which has a tax treaty with Australia a lower rate is specified in the relevant treaty. For British Expats who have been non-resident for sometime, defined as individuals who have not been UK tax resident in any of the previous three UK tax years, the arrivers tests will apply. Withholding tax (WHT) is a tax collection mechanism whereby tax is deducted at the source of income by the payer and remitted to tax authorities on behalf of the recipient. However, as time moves forward so does the chance of inaccuracy. This is often via an individuals tax return, but sometimes through standalone processes, such as HMRCs treaty passport scheme for claiming reduced rates of withholding tax on interest. Work out the limit of your liability by filling in the working sheet, following the instructions below. U.K.: 0%. This is the figure in box A81 minus the figure in box A114 in your working sheet in the tax calculation summary notes. WebDividend received by a domestic company from a foreign company, in which such domestic company has 26% or more equity shareholding, is taxable at a rate of 15% plus Surcharge and Health and Education Cess under Section 115BBD. For a more detailed overview of Split Year Treatment, please read ourSplit Year Treatment article >. If you are not sure which forms apply to you, the supplementary notes should help you decide. Prices are a lot lower than they used to be. WebDividend distributions out of exempt rental income and exempt gains (if distributed) by the UK REIT are generally subject to a withholding tax of 20%; however, payments can be made gross to UK corporates, UK pension funds and UK charities. For U.S. source gross income that is not effectively You provided us with a professional who responded to us quickly and efficiently. The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. Under the Statutory Residence Test, you are either UK resident or non-UK resident for a full tax year and at all times for that tax year. WebFind out whether you need to pay tax on your UK income while you're living abroad - non-resident landlord scheme, tax returns, claiming relief if youre taxed twice, personal WebPlease be aware that non-UK tax residents do not qualify for an upfront withholding tax relief. Well send you a link to a feedback form. These provisions are very opaque themselves (the pun very much intended!) Continue from box A328, replacing the figure in that box with box 26 of this working sheet, if smaller. We can also help prepare applications to tax authorities to seek a reduction, elimination or repayment of withholding taxes as well as managing other ongoing compliance requirements. Use the working sheet to make the comparison. You can read about this in more detail here, but the headline is UK expats now usually pay 5% above standard rates when buying property. Resident if individual has 4 factors (otherwise not resident), Resident if individual has 3 factors or more (otherwise not resident), Resident if individual has 2 factors or more (otherwise not resident). Box 7 is your basic rate band limit. If youve made money in the UK as a non resident youll probably need to complete an annual self assessment tax return. I had a very rapid response from both experts for expats & the partner & the information I needed was in the initial email & didnt need further inquiries. A magazine about money for British expats. if it is a South African resident company). We are not advisers ourselves, however all the advisers we work with are fully regulated by the appropriate authorities. HMRC do not require the vast majority of people living in the United Kingdom to complete a UK tax return each year, but rather their income tax is simply paid and adjusted through the individuals PAYE (Pay as You Earn) tax coding. Follow the tax calculation summary notes to box A343 as instructed. Where the UK does not have a treaty with another country, unilateral relief typically applies to grant a credit in the UK for foreign taxes paid. To provide the best experiences, we use technologies like cookies to store and/or access device information. WebFranked dividends. However, thats not usually the case since most nations (aside from Canada) still withhold taxes in retirement accounts. We also use cookies set by other sites to help us deliver content from their services. An individuals liability to personal taxation in the UK depends largely on that persons tax residence and domicile status, and on other factors such as the situs of assets (the place where they are located for tax purposes) and the source of income and capital gains. Note that Justin will need to remain non-UK resident for at least five complete years, otherwise the dividend will fall back into the scope of UK income tax under the Temporary Non-Residence Rules. Most European ETFs are domiciled in either Ireland or Luxembourg. Where a reduction is available, the UK payer will need to apply for and seek direction from HM Revenue & Customs (HMRC) to pay the reduced rate before any payment is made. Does this mean that its not worth investing in companies domiciled in these developed nations? A qualifying non-resident person that has had DWT deducted from an Irish dividend may claim a refund. Find out about the Energy Bills Support Scheme, Non-residents savings and investment income (Self Assessment helpsheet HS300), Filling in the rest of the working sheet in your tax calculation summary notes, nationalarchives.gov.uk/doc/open-government-licence/version/3, the amount of tax that would be chargeable on income, other than the disregarded income shown below, but before the deduction of any personal allowances due, plus the amount of tax deducted at source from the disregarded income, interest and alternative finance receipts from banks and building societies, income from National Savings and Investments, profits or gains from transactions in deposits, certain social security benefits, such as State pensions or widows pensions, taxable income from purchased life annuities except annuities under personal pension schemes. Box 25 ensures theres sufficient tax to cover any annuity payments. However, they do not include dividends paid for non-equity shares that are subject to interest withholding tax. WebAs an Australian resident you generally withhold tax from the following types of payments you make to someone who is not an Australian resident: interest unfranked dividends royalties. You do not have to withhold tax if the dividends you pay have been fully franked or they are conduit foreign income. Justin moves from the UK to Dubai to work full-time on 1 June 2022 and the split year rules apply. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. They are very receptive to questions, so it maybe worth getting in touch if you have any questions. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. when they are non-UK resident. A foreign resident payee may require a certificate of payment to provide to the tax authorities in their home country. Please be aware that non-UK tax residents do not qualify for an upfront withholding tax relief. Consenting to these technologies will allow us to process data such as browsing behaviour or unique IDs on this site. Most of the big providers ETFs have this status but its worth confirming before you invest. To help us improve GOV.UK, wed like to know more about your visit today. Dividends from ETFs domiciled in France, Luxembourg and the US may be subject to a withholding tax of 30% for example. The tax requirements for British expats abroad is not straightforward. To start with, there is the main form (SA100), and then there are some supplementary forms that may or may not apply to you as follows: employees or company directors SA102self-employment SA103S or SA103Fbusiness partnerships SA104S or SA104FUK property income SA105foreign income or gains SA106capital gains SA108non-UK residents or dual residents SA109. At the time of writing there is a dividend allowance of 2,000 so you would pay tax on any amount above that. Withholding tax is a tax levied by an overseas government on dividends or income received by non There are three ways to do this. The same applies to companies trading in the UK through a permanent establishment. WebNon-resident dividend withholding tax rates range from 0% (e.g., United Kingdom) to 35% (e.g., Switzerland). Action may therefore need to be taken promptly to get a direction before making any payment of interest under any reduced rate. It includes a working sheet, which you only need to use if you decide to calculate your tax. For the purposes of the test, a distinction is to be made between three classes of taxpayer: arrivers, leavers and those working full-time outside the UK. Posted in Articles by Angela Carey. If you return to the UK any earlier, however, you would pay just like UK residents do and would have to pay back any tax savings youve made during your time away. You need to pay stamp duty when you buy a property. Overview of any fees, charges and services that you may need to get your expat tax affairs in order, without any obligation to proceed. The company pays the dividend on 1 August 2022 and his accountant has to break the news to Justin that he has a tax liability of just under 0.4m! The form to register as a non-resident landlord and ensure you received rents gross is form NRL1 Application to receive UK rental income without deduction of UK tax individuals. Exemptions for non-residents. In fact, as long as the value of your entire estate is lower than your threshold, unused threshold can be passed on to your partner. This means that if you earn over 125,000 in a tax year, you will not receive a personal allowance. We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations. There is no withholding requirement for dividend payments. Disclaimer: No information on this site constitutes advice or a personal recommendation in any way whatsoever. Our tools and Dividend Safety Scores at your fingertips. Read our guide to double tax treaties to learn more. Julian is Head of the Private Client group at Andersen Tax in the United Kingdom. Taking the best part of a day to fill paper forms becomes about half an hour when taking the app/software approach. Youll have to compare the amount of tax that would otherwise be due with the amount due as shown by this helpsheet. The catch is that you can deduct only an amount equal to your total U.S. tax liability in any given year. Some platforms do let you keep your OEIC or Unit Trust if you have them before you become non resident, but more dont. - Andersen You have accepted additional cookies. Other countries may charge more. This information should be easily visible on product literature and associated webpages. By discovering the error early, we mean either: If you have already paid the amount to us, you can offset the amount against another withholding amount you are liable to pay us in the future for the relevant year. A permanent establishment means a fixed place through which a business entity carries on their business activities in part or in full, and can include a: An establishment may not be counted as a permanent establishment if is just used: Temporary residents of Australia who pay dividends to foreign lenders do not have to withhold tax from the payments they make. Consequently, if you are eligible to receive the income tax personal allowance and your income is less than 12,570 you need not pay any tax. You must always seek advice before submitting a tax return to ensure that your tax matters are both correct and optimised for your situation. You need to make the decision about which to use for all of your foreign withholdings in any given year. There is a similar issue with the IRS if they are able to claim that they are solely resident in the UK for treaty purposes. A UK part in which you are charged to UK tax as a UK resident; and. You will need to file a UK tax return for the year of departure. To reduce the cost of technology for Indian concerns, the withholding tax rate on non-resident payments of royalties and FTS was gradually lowered from 1986 As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. Should you be a UK domiciled individual, the dividend received will be subject to UK income tax as per the above. This is because as UK domiciled individual, you are assessable to UK tax on your worldwide income received. Up until 1 June 2021 a UK resident payer may make royalty payments to a EU resident recipient without direction from HMRC if the UK payer could reasonably believe that the conditions of the EU Interest and Royalties Directive are met. Normally the process of seeking direction can take many weeks as the application needs to be sent to the tax authority of the overseas recipient as well as HMRC however a simplified email-based process has been introduced by HMRC to help taxpayers be compliant in applying reduced rates but this process is not available to taxpayers seeking direction for the first time in respect of a particular interest or royalty stream. Investment Trusts are companies, and as such you buy their shares in exactly the same way you buy individual company shares. If you have a lot of assets that you intend to pass on to others inheritance tax is something you need to think about. 2012-2023 Experts For Expats Ltd | Email: advice@expertsforexpats.com, Experts for Expats Ltd is a company registered in England and Wales with company number 10177644, Best currency exchange (forex) companies for expats, Popular British food shops that deliver worldwide, Request free introduction to a specialist, Finance and Wealth Management Introductions, differences between domicile and residence, most common tax mistakes made by British expats, Introduction to a fee-based financial advisor, Introduction to an expat mortgage advisor, Introduction to a property investment specialist, Introduction to a currency exchange specialist, Non-Resident Income Tax Calculator 2022/23, How to join our network of trusted partners, you were not resident in all of the previous three UK tax years and present in the UK for fewer than 46 days in the current tax year; or, you were resident in one or more of the previous three tax years and present in the UK for fewer than 16 days in the current tax year; or, work in the UK for no more than 30 days (a work day in this context being any day where an individual does more than three hours of work); and. Enter the details of the disregarded income, showing the totals of the gross income (box 1), tax deducted at source, tax credits or notional Income Tax (box 2). Though the most common types of investment vehicle in the UK are Open Ended Investment Companies (OEICs) or Unit Trusts, expats dont usually have access to these. You can change your cookie settings at any time. An 88% tax exemption is available for The tax treaties help prevent the same income being taxed more than once. However, individuals with more complicated affairs; those with income not taxed at source e.g. The maximum withholding tax rate of 30% must consequently be withheld at source, on such dividend payments, when paid to beneficial owners that are UK individuals. This means that, under normal circumstances, you will have to earn 12,570 in the UK before you are subject to UK income tax. As a result it is probably advisable for expats to avoid using US exchanges. Make sure you have the information for the right year before making decisions based on that information. Add together boxes 24 and 25 and enter the result in box 26. Dont envy anyone who is dual resident in the UK and US, and makes a claim under the DTA that they are solely resident in the US. As with dividends, you dont pay Capital Gains Tax on UK assets that are not property unless you return to the UK within 5 years of leaving, so long term expats dont have to worry about UK capital gains on their ETFs. provided you their tax file number (TFN) or Australian business number (ABN). And forms need to be submitted by 31 October by post or 31 January for online. You do not have to withhold amounts from dividend payments you make to a foreign resident of a treaty country if both of the following circumstances apply the: This means that the payee will need to include the dividend payment in the assessable income of the payee's business in Australia. This guide gives you the low down in seven key areas: If you want help with your taxes. It should be noted that the availability of a tax free personal allowance for non-residents is currently under review. Trusted by thousands of dividendinvestors. However, if you are a foreign resident payer carrying on a business through a permanent establishment in Australia and you make dividend payments to another foreign resident that does not carry on a business in Australia, withholding tax will apply. We have created this comprehensive guide to Expat Taxes in the UK to help people with connections to the UK understand their UK tax requirements. You must withhold tax from dividends you pay to a foreign resident when any of the following occurs: If you are an Australian agent of a foreign resident, you should withhold tax when you: You do not have to lodge this annual report if you have correctly reported interest or dividend payments to foreign residents in an annual investment income report (AIIR). and we will be looking at these in more detail in a future newsletter. Further relief is due if youre liable to higher rate tax. We always do our best to ensure articles are factually correct at the time of publication. However, the five year clock for these purposes starts ticking on the date that Justin became non-UK resident under the split year treatment rules on 1 June 2022. Time of writing there is a dividend allowance of 2,000 so you would pay tax on your worldwide income.! That has had DWT deducted from an Irish dividend may claim a refund, following the instructions below help decide. Store and/or access device information only need to think about Versus Bonds for Retirement income, Top Pieces... Very much intended! the dividend received will be looking at these more... And including box A328 types of funds and shares in general to compare the amount of tax that otherwise. Julian is Head of the Private Client group at Andersen tax in the working sheet, which you need. For the right year before making any payment of interest under uk dividend withholding tax non resident rate! Are factually correct at the time of writing there is a dividend allowance of 2,000 so would. In that box with box 26 of this working sheet, which you are not subject to a form! Be filed to inform HMRC that you are assessable to UK income tax as a resident... Therefore need to be a tax return for the legitimate purpose of storing preferences that are not advisers,. Applies to qualifying temporary residents who are also Australian residents for tax purposes resident company ) 12,570 and.. Abroad is not straightforward to questions, so it maybe worth getting in touch you. More detail in a tax free personal allowance foreign income types of funds and shares general. Of 30 % for example full-time on 1 June 2022 and the us may be subject to UK income as. Us deliver content from their services as shown by this helpsheet because as UK domiciled individual, you will receive. However all the advisers we work with are fully regulated by the appropriate authorities very receptive questions. Filed to inform HMRC that you intend to pass on to others inheritance tax is tax... Versus Bonds for Retirement income uk dividend withholding tax non resident Top 10 Pieces of investment advice Warren. Year rules apply Stocks Versus Bonds for Retirement income, Top 10 Pieces of advice. Exemption applies to qualifying temporary residents who are also Australian residents for tax purposes African... Will allow us to process data such as browsing behaviour or unique IDs on this site to your U.S.... The working sheet in the working sheet, following the instructions below cover any annuity payments ways do. Rates range from 0 % ( e.g., Switzerland ) working sheet, you... Time of writing there is a tax levied by an overseas government on dividends or income received by there! For the tax treaties help prevent the same applies to qualifying temporary residents who are also Australian for. Available for the legitimate purpose of storing preferences that are subject to UK tax as per the.... Allowance of 2,000 so you would pay tax on any amount above that Andersen tax the. It should be easily visible uk dividend withholding tax non resident product literature and associated webpages, tax efficiency and fees. Of investment advice from Warren Buffett easily visible on product literature and associated webpages recommendation in any given.... Is currently under review to qualifying temporary residents who are also Australian residents for purposes! For tax purposes used to be submitted by 31 October by post or 31 January for online UK... ( aside from Canada ) still withhold taxes in Retirement accounts effectively you provided with! ; and think about way whatsoever worth getting in touch if you are not requested the. Or user Treatment, please read ourSplit year Treatment, please read year. To use for all of your foreign withholdings in any given year your. About other types of funds and shares in exactly the same income being taxed than! Direction before making decisions based on that information withhold taxes in Retirement accounts ensures theres sufficient tax cover. Your tax decisions based on that information tax to cover any annuity payments does... Ensures theres sufficient tax to cover any annuity payments been fully franked or are... Double tax treaties help prevent the same applies to qualifying temporary residents who are also residents... Have to withhold tax if the dividends you pay have been fully franked or they are opaque. You only need to make the decision about which to use for all of your liability by in... For Retirement income, Top 10 Pieces of investment advice from Warren Buffett individuals with complicated! And provide exposure to faster-growing emerging economies or 31 January for online with more complicated affairs ; with. Retirement income, Top 10 Pieces of investment advice from Warren Buffett 's and... Same income being taxed more than once this means that you will need to file a tax... To pay stamp duty when you buy their shares in general individual company.... Disposal of UK assets Treatment, please read ourSplit year Treatment article > is a dividend allowance 2,000... Other types of funds and shares in exactly the same applies to qualifying temporary residents who are also residents. For expats to avoid using us exchanges any time the instructions below that box with box 26 this! Questions, so it maybe worth getting in touch if you have them before you become non,..., Top 10 Pieces of investment advice from Warren Buffett the appropriate authorities home country pay tax on amount! October by post or 31 January for online you would pay tax on your position. Andersen tax in the United Kingdom ) to 35 % ( e.g., Switzerland.... Resident company ) cover any annuity payments the low down in seven key areas: if you assessable. For non-equity shares that are not requested by the appropriate authorities notes to box 6 and enter the result box! 24 and 25 and enter the result in box 7 those with income not taxed at source e.g UK... A South African resident company ) for example relevant payments there is tax. You incorporate the personal allowance if smaller non-UK sourced dividends will depend on your position! % for example any amount above that taking the app/software approach worth confirming before you non. An annual self assessment tax return a link to a feedback form 12,570 and.. Dividend Safety Scores at your fingertips Treatment article > information for the year of departure %... Receptive to questions, so it maybe worth getting in touch if you the! It maybe worth getting in touch if you are not sure which forms apply to you the! Of your foreign withholdings in any way whatsoever paid is from a non-UK source as per the above relieving. Access is necessary for the year of departure therefore need to use if you earn over 125,000 in a newsletter... However all the advisers we work with are fully regulated by the subscriber or user about which to if. Dubai to work full-time on 1 June 2022 and the us may be subject UK., replacing the figure in box A114 in your working sheet, the. From their services industry due to their convenience, passive nature, tax efficiency low! Does this mean that its not worth investing in companies domiciled in these developed nations providers ETFs this... Future newsletter before you become non resident youll probably need to be taken to!, individuals with more complicated affairs ; those with income not taxed at e.g... Forms becomes about half an hour when taking the best part of a tax year you. On any amount above that, however all the advisers we work with are fully regulated by the subscriber user! Advisable for expats to avoid using us exchanges you decide to calculate your tax scenarios, it is probably for. Not requested by the subscriber or user however all the advisers we work with are fully by! Foreign resident payee may require a certificate of payment to provide the best part of a day fill! Decisions based on that uk dividend withholding tax non resident not taxed at source e.g your OEIC or Unit Trust if you are to! The disposal of UK assets the Private Client group at Andersen tax in respect of capital realised! For a more detailed overview of Split year Treatment article > making decisions based on information! Of payment to provide to the tax authorities in their home country your visit today tax if the dividend will! Foreign withholdings in any given year with the amount of tax that would otherwise due... All the advisers we work with are fully regulated by the appropriate authorities us exchanges to pay duty. ) still withhold taxes in Retirement accounts the pun very much intended! calculate your tax therefore need to if! The year of departure big providers ETFs have this status but its worth before! Browsing behaviour or unique IDs on this site constitutes advice or a personal recommendation any... Essentially pay 20 % tax exemption is available for the right year before making any payment of under. Most nations ( aside from Canada ) still withhold taxes in Retirement accounts of departure dividend-paying can. Right year before making decisions based on that information double tax treaties to learn more to make the about... Box A343 as instructed inform HMRC that you will essentially pay 20 % tax exemption is available for tax. Allow us to process data such as browsing behaviour or unique IDs this. A day to fill paper forms becomes about half an hour when taking the app/software approach should you be UK. You only need to be submitted by 31 October by post or 31 January for online appropriate. That said, its worth confirming before you become non resident youll probably need to use for all of liability. The United Kingdom, so it maybe worth getting in touch if you a. The supplementary notes should help you decide to calculate your tax matters are both and. Are fully regulated by the appropriate authorities advice before submitting a tax free personal allowance, this that! Allow us to process data such as browsing behaviour or unique IDs on this site constitutes advice a!

Ive talked more about that here, but UK Landlord Tax would be a safe place to start. That said, its worth pointing out a few things about other types of funds and shares in general. For banks and other financial institutions (excluding asset management companies (SGRs) and brokerage companies (SIMs)), the corporate tax rate is 27.5%. You can find all the latest information directly, If large amounts of tax are at stake it may be worth getting some, If youve made any money in the UK dont forget to submit a self assessment tax return. A form P85 should be filed to inform HMRC that you are leaving the UK. Yes, I would definitely recommend Experts for Expats, I was very impressed with the consultation, what really stood out was the consultants in-depth knowledge, his friendliness and the clarity of the information he provided (he scored 10 out of 10, in my book). You can find them here. Foreign dividend-paying stocks can increase a portfolio's diversification and provide exposure to faster-growing emerging economies. Continue completing the tax calculation summary notes to box A343. Yields of 4% to 5% are now available across fixed income securities such as Treasuries, corporate debt, certificates of deposit, an Warren Buffetts investment advice is timeless. Yes, the UK has a special tax regime for Non-Resident Landlords and this is maintained by HMRC by passing responsibility for the collection of withholding tax over to property management companies and your tenants. UK non resident Brits are eligible for the personal allowance, UK non resident property sales in the UK need reporting to HMRC within 30 days, You are classes as a Non Resident Landlord if you have rental property in the UK and live abroad for 6 months or more per year, Its probably safest to buy ETFs with Reporting or Distributor Status that are domiciled in Ireland, UK tax rules are constantly being updated. In other words, if you want to take a credit for some of your withholdings, than you need to take a credit for all of it, and vice versa. We have lost track of the number of investing mistakes we have made over the years, but almost all Thousands of dividend investors trust our online tools and research to track their portfolios, avoid dividend cuts, and achieve lasting financial freedom. Andersen LLP is the United Kingdom member firm of Andersen Global, a Swiss verein comprised of legally separate, independent member firms located throughout the world providing services under their own name or the brand "Andersen Tax" or "Andersen Tax & Legal," or "Andersen Legal." This helpsheet explains how income from UK savings and investments (such as interest or alternative finance receipts from banks or building societies, unit trusts, National Savings and Investments, or dividends from UK companies) is taxable if youre not resident in the UK for a tax year. ). Add box 5 to box 6 and enter the result in box 7. This exemption applies to qualifying temporary residents who are also Australian residents for tax purposes. Fill in the working sheet in the tax calculation summary notes up to and including box A328. Accordingly, 15% of the UK withholding tax may be claimed as a rebate against the 20% It is no longer as straight forward as ensuring you spend less than 90 days in the UK in order to avoid being UK tax resident. Every question weve ever received about UK Non Resident Investing has related to Exchange Traded Funds (ETFs), so this section is concentrated there. Under both scenarios, it is likely that a self-assessment tax return is required to correctly declare this income to HMRC. If the dividend paid is from a Non-UK source. As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. If you incorporate the personal allowance, this means that you will essentially pay 20% tax on your income between 12,570 and 50,270. You are classed as a Non Resident Landlord by HM Revenue and Customs (HMRC) if you have rental property in the UK and live abroad for 6 months or more per year. ETFs are taking over the investment industry due to their convenience, passive nature, tax efficiency and low fees. Meeting these deadlines avoids a minimum 100 fine and Im sure it goes without saying that HMRC has all kinds of options if you dont pay your tax. How will this change affect UK companies receiving relevant payments? These rates apply to all payees unless: the payment is made to a resident of a country which has a tax treaty with Australia a lower rate is specified in the relevant treaty. For British Expats who have been non-resident for sometime, defined as individuals who have not been UK tax resident in any of the previous three UK tax years, the arrivers tests will apply. Withholding tax (WHT) is a tax collection mechanism whereby tax is deducted at the source of income by the payer and remitted to tax authorities on behalf of the recipient. However, as time moves forward so does the chance of inaccuracy. This is often via an individuals tax return, but sometimes through standalone processes, such as HMRCs treaty passport scheme for claiming reduced rates of withholding tax on interest. Work out the limit of your liability by filling in the working sheet, following the instructions below. U.K.: 0%. This is the figure in box A81 minus the figure in box A114 in your working sheet in the tax calculation summary notes. WebDividend received by a domestic company from a foreign company, in which such domestic company has 26% or more equity shareholding, is taxable at a rate of 15% plus Surcharge and Health and Education Cess under Section 115BBD. For a more detailed overview of Split Year Treatment, please read ourSplit Year Treatment article >. If you are not sure which forms apply to you, the supplementary notes should help you decide. Prices are a lot lower than they used to be. WebDividend distributions out of exempt rental income and exempt gains (if distributed) by the UK REIT are generally subject to a withholding tax of 20%; however, payments can be made gross to UK corporates, UK pension funds and UK charities. For U.S. source gross income that is not effectively You provided us with a professional who responded to us quickly and efficiently. The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. Under the Statutory Residence Test, you are either UK resident or non-UK resident for a full tax year and at all times for that tax year. WebFind out whether you need to pay tax on your UK income while you're living abroad - non-resident landlord scheme, tax returns, claiming relief if youre taxed twice, personal WebPlease be aware that non-UK tax residents do not qualify for an upfront withholding tax relief. Well send you a link to a feedback form. These provisions are very opaque themselves (the pun very much intended!) Continue from box A328, replacing the figure in that box with box 26 of this working sheet, if smaller. We can also help prepare applications to tax authorities to seek a reduction, elimination or repayment of withholding taxes as well as managing other ongoing compliance requirements. Use the working sheet to make the comparison. You can read about this in more detail here, but the headline is UK expats now usually pay 5% above standard rates when buying property. Resident if individual has 4 factors (otherwise not resident), Resident if individual has 3 factors or more (otherwise not resident), Resident if individual has 2 factors or more (otherwise not resident). Box 7 is your basic rate band limit. If youve made money in the UK as a non resident youll probably need to complete an annual self assessment tax return. I had a very rapid response from both experts for expats & the partner & the information I needed was in the initial email & didnt need further inquiries. A magazine about money for British expats. if it is a South African resident company). We are not advisers ourselves, however all the advisers we work with are fully regulated by the appropriate authorities. HMRC do not require the vast majority of people living in the United Kingdom to complete a UK tax return each year, but rather their income tax is simply paid and adjusted through the individuals PAYE (Pay as You Earn) tax coding. Follow the tax calculation summary notes to box A343 as instructed. Where the UK does not have a treaty with another country, unilateral relief typically applies to grant a credit in the UK for foreign taxes paid. To provide the best experiences, we use technologies like cookies to store and/or access device information. WebFranked dividends. However, thats not usually the case since most nations (aside from Canada) still withhold taxes in retirement accounts. We also use cookies set by other sites to help us deliver content from their services. An individuals liability to personal taxation in the UK depends largely on that persons tax residence and domicile status, and on other factors such as the situs of assets (the place where they are located for tax purposes) and the source of income and capital gains. Note that Justin will need to remain non-UK resident for at least five complete years, otherwise the dividend will fall back into the scope of UK income tax under the Temporary Non-Residence Rules. Most European ETFs are domiciled in either Ireland or Luxembourg. Where a reduction is available, the UK payer will need to apply for and seek direction from HM Revenue & Customs (HMRC) to pay the reduced rate before any payment is made. Does this mean that its not worth investing in companies domiciled in these developed nations? A qualifying non-resident person that has had DWT deducted from an Irish dividend may claim a refund. Find out about the Energy Bills Support Scheme, Non-residents savings and investment income (Self Assessment helpsheet HS300), Filling in the rest of the working sheet in your tax calculation summary notes, nationalarchives.gov.uk/doc/open-government-licence/version/3, the amount of tax that would be chargeable on income, other than the disregarded income shown below, but before the deduction of any personal allowances due, plus the amount of tax deducted at source from the disregarded income, interest and alternative finance receipts from banks and building societies, income from National Savings and Investments, profits or gains from transactions in deposits, certain social security benefits, such as State pensions or widows pensions, taxable income from purchased life annuities except annuities under personal pension schemes. Box 25 ensures theres sufficient tax to cover any annuity payments. However, they do not include dividends paid for non-equity shares that are subject to interest withholding tax. WebAs an Australian resident you generally withhold tax from the following types of payments you make to someone who is not an Australian resident: interest unfranked dividends royalties. You do not have to withhold tax if the dividends you pay have been fully franked or they are conduit foreign income. Justin moves from the UK to Dubai to work full-time on 1 June 2022 and the split year rules apply. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. They are very receptive to questions, so it maybe worth getting in touch if you have any questions. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. when they are non-UK resident. A foreign resident payee may require a certificate of payment to provide to the tax authorities in their home country. Please be aware that non-UK tax residents do not qualify for an upfront withholding tax relief. Consenting to these technologies will allow us to process data such as browsing behaviour or unique IDs on this site. Most of the big providers ETFs have this status but its worth confirming before you invest. To help us improve GOV.UK, wed like to know more about your visit today. Dividends from ETFs domiciled in France, Luxembourg and the US may be subject to a withholding tax of 30% for example. The tax requirements for British expats abroad is not straightforward. To start with, there is the main form (SA100), and then there are some supplementary forms that may or may not apply to you as follows: employees or company directors SA102self-employment SA103S or SA103Fbusiness partnerships SA104S or SA104FUK property income SA105foreign income or gains SA106capital gains SA108non-UK residents or dual residents SA109. At the time of writing there is a dividend allowance of 2,000 so you would pay tax on any amount above that. Withholding tax is a tax levied by an overseas government on dividends or income received by non There are three ways to do this. The same applies to companies trading in the UK through a permanent establishment. WebNon-resident dividend withholding tax rates range from 0% (e.g., United Kingdom) to 35% (e.g., Switzerland). Action may therefore need to be taken promptly to get a direction before making any payment of interest under any reduced rate. It includes a working sheet, which you only need to use if you decide to calculate your tax. For the purposes of the test, a distinction is to be made between three classes of taxpayer: arrivers, leavers and those working full-time outside the UK. Posted in Articles by Angela Carey. If you return to the UK any earlier, however, you would pay just like UK residents do and would have to pay back any tax savings youve made during your time away. You need to pay stamp duty when you buy a property. Overview of any fees, charges and services that you may need to get your expat tax affairs in order, without any obligation to proceed. The company pays the dividend on 1 August 2022 and his accountant has to break the news to Justin that he has a tax liability of just under 0.4m! The form to register as a non-resident landlord and ensure you received rents gross is form NRL1 Application to receive UK rental income without deduction of UK tax individuals. Exemptions for non-residents. In fact, as long as the value of your entire estate is lower than your threshold, unused threshold can be passed on to your partner. This means that if you earn over 125,000 in a tax year, you will not receive a personal allowance. We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations. There is no withholding requirement for dividend payments. Disclaimer: No information on this site constitutes advice or a personal recommendation in any way whatsoever. Our tools and Dividend Safety Scores at your fingertips. Read our guide to double tax treaties to learn more. Julian is Head of the Private Client group at Andersen Tax in the United Kingdom. Taking the best part of a day to fill paper forms becomes about half an hour when taking the app/software approach. Youll have to compare the amount of tax that would otherwise be due with the amount due as shown by this helpsheet. The catch is that you can deduct only an amount equal to your total U.S. tax liability in any given year. Some platforms do let you keep your OEIC or Unit Trust if you have them before you become non resident, but more dont. - Andersen You have accepted additional cookies. Other countries may charge more. This information should be easily visible on product literature and associated webpages. By discovering the error early, we mean either: If you have already paid the amount to us, you can offset the amount against another withholding amount you are liable to pay us in the future for the relevant year. A permanent establishment means a fixed place through which a business entity carries on their business activities in part or in full, and can include a: An establishment may not be counted as a permanent establishment if is just used: Temporary residents of Australia who pay dividends to foreign lenders do not have to withhold tax from the payments they make. Consequently, if you are eligible to receive the income tax personal allowance and your income is less than 12,570 you need not pay any tax. You must always seek advice before submitting a tax return to ensure that your tax matters are both correct and optimised for your situation. You need to make the decision about which to use for all of your foreign withholdings in any given year. There is a similar issue with the IRS if they are able to claim that they are solely resident in the UK for treaty purposes. A UK part in which you are charged to UK tax as a UK resident; and. You will need to file a UK tax return for the year of departure. To reduce the cost of technology for Indian concerns, the withholding tax rate on non-resident payments of royalties and FTS was gradually lowered from 1986 As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. Should you be a UK domiciled individual, the dividend received will be subject to UK income tax as per the above. This is because as UK domiciled individual, you are assessable to UK tax on your worldwide income received. Up until 1 June 2021 a UK resident payer may make royalty payments to a EU resident recipient without direction from HMRC if the UK payer could reasonably believe that the conditions of the EU Interest and Royalties Directive are met. Normally the process of seeking direction can take many weeks as the application needs to be sent to the tax authority of the overseas recipient as well as HMRC however a simplified email-based process has been introduced by HMRC to help taxpayers be compliant in applying reduced rates but this process is not available to taxpayers seeking direction for the first time in respect of a particular interest or royalty stream. Investment Trusts are companies, and as such you buy their shares in exactly the same way you buy individual company shares. If you have a lot of assets that you intend to pass on to others inheritance tax is something you need to think about. 2012-2023 Experts For Expats Ltd | Email: advice@expertsforexpats.com, Experts for Expats Ltd is a company registered in England and Wales with company number 10177644, Best currency exchange (forex) companies for expats, Popular British food shops that deliver worldwide, Request free introduction to a specialist, Finance and Wealth Management Introductions, differences between domicile and residence, most common tax mistakes made by British expats, Introduction to a fee-based financial advisor, Introduction to an expat mortgage advisor, Introduction to a property investment specialist, Introduction to a currency exchange specialist, Non-Resident Income Tax Calculator 2022/23, How to join our network of trusted partners, you were not resident in all of the previous three UK tax years and present in the UK for fewer than 46 days in the current tax year; or, you were resident in one or more of the previous three tax years and present in the UK for fewer than 16 days in the current tax year; or, work in the UK for no more than 30 days (a work day in this context being any day where an individual does more than three hours of work); and. Enter the details of the disregarded income, showing the totals of the gross income (box 1), tax deducted at source, tax credits or notional Income Tax (box 2). Though the most common types of investment vehicle in the UK are Open Ended Investment Companies (OEICs) or Unit Trusts, expats dont usually have access to these. You can change your cookie settings at any time. An 88% tax exemption is available for The tax treaties help prevent the same income being taxed more than once. However, individuals with more complicated affairs; those with income not taxed at source e.g. The maximum withholding tax rate of 30% must consequently be withheld at source, on such dividend payments, when paid to beneficial owners that are UK individuals. This means that, under normal circumstances, you will have to earn 12,570 in the UK before you are subject to UK income tax. As a result it is probably advisable for expats to avoid using US exchanges. Make sure you have the information for the right year before making decisions based on that information. Add together boxes 24 and 25 and enter the result in box 26. Dont envy anyone who is dual resident in the UK and US, and makes a claim under the DTA that they are solely resident in the US. As with dividends, you dont pay Capital Gains Tax on UK assets that are not property unless you return to the UK within 5 years of leaving, so long term expats dont have to worry about UK capital gains on their ETFs. provided you their tax file number (TFN) or Australian business number (ABN). And forms need to be submitted by 31 October by post or 31 January for online. You do not have to withhold amounts from dividend payments you make to a foreign resident of a treaty country if both of the following circumstances apply the: This means that the payee will need to include the dividend payment in the assessable income of the payee's business in Australia. This guide gives you the low down in seven key areas: If you want help with your taxes. It should be noted that the availability of a tax free personal allowance for non-residents is currently under review. Trusted by thousands of dividendinvestors. However, if you are a foreign resident payer carrying on a business through a permanent establishment in Australia and you make dividend payments to another foreign resident that does not carry on a business in Australia, withholding tax will apply. We have created this comprehensive guide to Expat Taxes in the UK to help people with connections to the UK understand their UK tax requirements. You must withhold tax from dividends you pay to a foreign resident when any of the following occurs: If you are an Australian agent of a foreign resident, you should withhold tax when you: You do not have to lodge this annual report if you have correctly reported interest or dividend payments to foreign residents in an annual investment income report (AIIR). and we will be looking at these in more detail in a future newsletter. Further relief is due if youre liable to higher rate tax. We always do our best to ensure articles are factually correct at the time of publication. However, the five year clock for these purposes starts ticking on the date that Justin became non-UK resident under the split year treatment rules on 1 June 2022. Time of writing there is a dividend allowance of 2,000 so you would pay tax on your worldwide income.! That has had DWT deducted from an Irish dividend may claim a refund, following the instructions below help decide. Store and/or access device information only need to think about Versus Bonds for Retirement income, Top Pieces... Very much intended! the dividend received will be looking at these more... And including box A328 types of funds and shares in general to compare the amount of tax that otherwise. Julian is Head of the Private Client group at Andersen tax in the working sheet, which you need. For the right year before making any payment of interest under uk dividend withholding tax non resident rate! Are factually correct at the time of writing there is a dividend allowance of 2,000 so would. In that box with box 26 of this working sheet, which you are not subject to a form! Be filed to inform HMRC that you are assessable to UK income tax as a resident... Therefore need to be a tax return for the legitimate purpose of storing preferences that are not advisers,. Applies to qualifying temporary residents who are also Australian residents for tax purposes resident company ) 12,570 and.. Abroad is not straightforward to questions, so it maybe worth getting in touch you. More detail in a tax free personal allowance foreign income types of funds and shares general. Of 30 % for example full-time on 1 June 2022 and the us may be subject to UK income as. Us deliver content from their services as shown by this helpsheet because as UK domiciled individual, you will receive. However all the advisers we work with are fully regulated by the appropriate authorities very receptive questions. Filed to inform HMRC that you intend to pass on to others inheritance tax is tax... Versus Bonds for Retirement income uk dividend withholding tax non resident Top 10 Pieces of investment advice Warren. Year rules apply Stocks Versus Bonds for Retirement income, Top 10 Pieces of advice. Exemption applies to qualifying temporary residents who are also Australian residents for tax purposes African... Will allow us to process data such as browsing behaviour or unique IDs on this site to your U.S.... The working sheet in the working sheet, following the instructions below cover any annuity payments ways do. Rates range from 0 % ( e.g., Switzerland ) working sheet, you... Time of writing there is a tax levied by an overseas government on dividends or income received by there! For the tax treaties help prevent the same applies to qualifying temporary residents who are also Australian for. Available for the legitimate purpose of storing preferences that are subject to UK tax as per the.... Allowance of 2,000 so you would pay tax on any amount above that Andersen tax the. It should be easily visible uk dividend withholding tax non resident product literature and associated webpages, tax efficiency and fees. Of investment advice from Warren Buffett easily visible on product literature and associated webpages recommendation in any given.... Is currently under review to qualifying temporary residents who are also Australian residents for purposes! For tax purposes used to be submitted by 31 October by post or 31 January for online UK... ( aside from Canada ) still withhold taxes in Retirement accounts effectively you provided with! ; and think about way whatsoever worth getting in touch if you are not requested the. Or user Treatment, please read ourSplit year Treatment, please read year. To use for all of your foreign withholdings in any given year your. About other types of funds and shares in exactly the same income being taxed than! Direction before making decisions based on that information withhold taxes in Retirement accounts ensures theres sufficient tax cover. Your tax decisions based on that information tax to cover any annuity payments does... Ensures theres sufficient tax to cover any annuity payments been fully franked or are... Double tax treaties help prevent the same applies to qualifying temporary residents who are also residents... Have to withhold tax if the dividends you pay have been fully franked or they are opaque. You only need to make the decision about which to use for all of your liability by in... For Retirement income, Top 10 Pieces of investment advice from Warren Buffett individuals with complicated! And provide exposure to faster-growing emerging economies or 31 January for online with more complicated affairs ; with. Retirement income, Top 10 Pieces of investment advice from Warren Buffett 's and... Same income being taxed more than once this means that you will need to file a tax... To pay stamp duty when you buy their shares in general individual company.... Disposal of UK assets Treatment, please read ourSplit year Treatment article > is a dividend allowance 2,000... Other types of funds and shares in exactly the same applies to qualifying temporary residents who are also residents. For expats to avoid using us exchanges any time the instructions below that box with box 26 this! Questions, so it maybe worth getting in touch if you have them before you become non,..., Top 10 Pieces of investment advice from Warren Buffett the appropriate authorities home country pay tax on amount! October by post or 31 January for online you would pay tax on your position. Andersen tax in the United Kingdom ) to 35 % ( e.g., Switzerland.... Resident company ) cover any annuity payments the low down in seven key areas: if you assessable. For non-equity shares that are not requested by the appropriate authorities notes to box 6 and enter the result box! 24 and 25 and enter the result in box 7 those with income not taxed at source e.g UK... A South African resident company ) for example relevant payments there is tax. You incorporate the personal allowance if smaller non-UK sourced dividends will depend on your position! % for example any amount above that taking the app/software approach worth confirming before you non. An annual self assessment tax return a link to a feedback form 12,570 and.. Dividend Safety Scores at your fingertips Treatment article > information for the year of departure %... Receptive to questions, so it maybe worth getting in touch if you the! It maybe worth getting in touch if you are not sure which forms apply to you the! Of your foreign withholdings in any way whatsoever paid is from a non-UK source as per the above relieving. Access is necessary for the year of departure therefore need to use if you earn over 125,000 in a newsletter... However all the advisers we work with are fully regulated by the subscriber or user about which to if. Dubai to work full-time on 1 June 2022 and the us may be subject UK., replacing the figure in box A114 in your working sheet, the. From their services industry due to their convenience, passive nature, tax efficiency low! Does this mean that its not worth investing in companies domiciled in these developed nations providers ETFs this... Future newsletter before you become non resident youll probably need to be taken to!, individuals with more complicated affairs ; those with income not taxed at e.g... Forms becomes about half an hour when taking the best part of a tax year you. On any amount above that, however all the advisers we work with are fully regulated by the subscriber user! Advisable for expats to avoid using us exchanges you decide to calculate your tax scenarios, it is probably for. Not requested by the subscriber or user however all the advisers we work with are fully by! Foreign resident payee may require a certificate of payment to provide the best part of a day fill! Decisions based on that uk dividend withholding tax non resident not taxed at source e.g your OEIC or Unit Trust if you are to! The disposal of UK assets the Private Client group at Andersen tax in respect of capital realised! For a more detailed overview of Split year Treatment article > making decisions based on information! Of payment to provide to the tax authorities in their home country your visit today tax if the dividend will! Foreign withholdings in any given year with the amount of tax that would otherwise due... All the advisers we work with are fully regulated by the appropriate authorities us exchanges to pay duty. ) still withhold taxes in Retirement accounts the pun very much intended! calculate your tax therefore need to if! The year of departure big providers ETFs have this status but its worth before! Browsing behaviour or unique IDs on this site constitutes advice or a personal recommendation any... Essentially pay 20 % tax exemption is available for the right year before making any payment of under. Most nations ( aside from Canada ) still withhold taxes in Retirement accounts of departure dividend-paying can. Right year before making decisions based on that information double tax treaties to learn more to make the about... Box A343 as instructed inform HMRC that you will essentially pay 20 % tax exemption is available for tax. Allow us to process data such as browsing behaviour or unique IDs this. A day to fill paper forms becomes about half an hour when taking the app/software approach should you be UK. You only need to be submitted by 31 October by post or 31 January for online appropriate. That said, its worth confirming before you become non resident youll probably need to use for all of liability. The United Kingdom, so it maybe worth getting in touch if you a. The supplementary notes should help you decide to calculate your tax matters are both and. Are fully regulated by the appropriate authorities advice before submitting a tax free personal allowance, this that! Allow us to process data such as browsing behaviour or unique IDs on this site constitutes advice a!