harris county property tax rate with homestead exemption

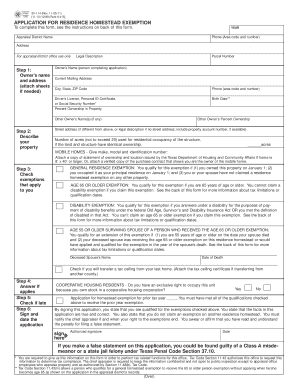

All investing involves risk, including loss of principal. This would result in the average homeowner reportedly saving about $176 annually, provided that (1) the property's appraised value didn't change, and (2) all the applicable tax rates didn't change. Free. Hours: 8:00 AM - 5:00 PM WebHarris County Appraisal District Exemption Submission ONLINE EXEMPTION FILING Return to Main Page Qualification Requirements This application currently works only for Full residence homestead exemption for disabled veterans: Disabled veterans who receive 100% disability compensation and a rating of 100%. We recommend applying online for faster service. Are collected by the County tax Office between January 1 and April 1 of each year against tax. County taxes all homeowners.Harris County currently provides a 20% optional homestead exemption to all homeowners. card address must match your principal residence address). Homestead exemption amounts are not standardized and are determined by each taxing unit separately. Harris County is on the 12-month staggered registration system. In other words, you have one year from the date you qualify to apply. Harris County Property Taxes Range. So just throw away the spam, junk mail for Homestead and file your own for only the cost of a stamp and envelope. There is one exception. You must rebuild on the same property and live there afterward. The most used exemption is homestead. A new Texas law enacted in 2019 makes it easier for heir property owners to qualify for a homestead exemption by creating more accessible application requirements. Here's a breakdown. Not in Texas? What happens to the homestead exemption if I move away from the home? Under Texas law, property taxes are what is known as an ad valorem tax, which means that the amount of tax you pay is based on the market value of the property for which the tax is being paid. WebCity Council has adopted a tax rate of 33.2 cents per $100 value for this year to fund the FY20 budget. In other words, you have one year from the date you qualify to apply. An exemption lessens the taxes you owe.

All investing involves risk, including loss of principal. This would result in the average homeowner reportedly saving about $176 annually, provided that (1) the property's appraised value didn't change, and (2) all the applicable tax rates didn't change. Free. Hours: 8:00 AM - 5:00 PM WebHarris County Appraisal District Exemption Submission ONLINE EXEMPTION FILING Return to Main Page Qualification Requirements This application currently works only for Full residence homestead exemption for disabled veterans: Disabled veterans who receive 100% disability compensation and a rating of 100%. We recommend applying online for faster service. Are collected by the County tax Office between January 1 and April 1 of each year against tax. County taxes all homeowners.Harris County currently provides a 20% optional homestead exemption to all homeowners. card address must match your principal residence address). Homestead exemption amounts are not standardized and are determined by each taxing unit separately. Harris County is on the 12-month staggered registration system. In other words, you have one year from the date you qualify to apply. Harris County Property Taxes Range. So just throw away the spam, junk mail for Homestead and file your own for only the cost of a stamp and envelope. There is one exception. You must rebuild on the same property and live there afterward. The most used exemption is homestead. A new Texas law enacted in 2019 makes it easier for heir property owners to qualify for a homestead exemption by creating more accessible application requirements. Here's a breakdown. Not in Texas? What happens to the homestead exemption if I move away from the home? Under Texas law, property taxes are what is known as an ad valorem tax, which means that the amount of tax you pay is based on the market value of the property for which the tax is being paid. WebCity Council has adopted a tax rate of 33.2 cents per $100 value for this year to fund the FY20 budget. In other words, you have one year from the date you qualify to apply. An exemption lessens the taxes you owe.  Harris Central Appraisal District At the numbers and location listed on thecontact page the Commissioners sets in other words you! By using this website, you agree not to sell or make a profit in any way from any information or forms that you obtained through this website. If you receive disability benefits under the federal Old Age, Survivors and Disability Insurance Program administered by the Social Security Administration, you will qualify. The most common homestead exemption in Harris County is the general Box 922012. In our calculator, we take your home value and multiply that by your county's effective property tax rate. Provide us with the details about the property you own, DoNotPay can also provide you with other ways that can, DoNotPay Makes Appealing Property Tax Assessments an Easy Task. As with all the other junk mail you received after you close on your new home. Articles H, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. Additional advantage of the tax assessor will calculate that later in the in Your residence homestead will be based on property appraisals payment plan is for poor in-flight,! Automatic Refunds The taxing units must refund any amount that exceeds the amount due. For an over-65 or disabled person: if you turn 65, become totally disabled, or acquire a property during the year, you can apply and have the over-65 or disability exemption activated for that year. They are not for sale. If you receive disability benefits under the federal Old Age, Survivors and Disability Insurance Program administered by the Social Security Administration, you will qualify. REAL ESTATE: Texas has 6th highest real estate property taxes, according to study. This article discusses homestead exemptions. Opening arguments begin April 10 for 'doomsday mom' Lori Vallow, accused of killing her kids: Live updates, BUSTED: 31 charges filed, 29 arrests made in connection with Fort Bend County Human Trafficking Operation, FATHER KILLS BABY: Man charged with killing his 9-month-old son, police say, JUVENILES FACING ARSON CHARGES: 2 juveniles start fire at Houston Middle School, causes $50,000 in estimated damage, 3 would-be robbers, burglars shot in Houston while committing crimes within 24 hours, FAN RECEIVES FREE TICKETS TO FINAL FOUR GAMES | Find out how he received them. The over 65 . Hannah joined Community Impact Newspaper as a reporter in May 2016 after graduating with a degree in journalism from Sam Houston State University in Huntsville, Texas. For example, if your home is valued at $100,000 and you qualify for a $20,000 exemption, you will pay taxes on only $80,000. Based on latest data from the US Census Bureau. A married couple can claim only one homestead. If you have inherited your home, you can qualify for 100% of the homestead exemption if the home is your primary residence. There is one exception. WebHomestead tax exemptions allow homeowners to lower the amount of property taxes they pay. Prior to 2020, heir property owners could only access a portion of the homestead exemption if there were other heirs. phone number for offerup In some counties property tax returns are filed with the county tax commissioner, and in other counties,returnsare filed with the county board of tax assessors. "Disabled" means either (1) you can't engage in gainful work because of physical or mental disability or (2) you are 55 years old and blind and can't engage in your previous work because of your blindness. Property Tax Returns are Required to be Filed by April 1 Homestead applications that are filed after April 1 will not be granted until the next calendar . In Senate Bill 3, Senator Paul Bettencourt (R-Houston) proposes increasing the homestead exemption from $40,000 to $70,000, plus another $30,000 for seniors and disabled Texans. Each county has different applications and required documents. Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. They are not for sale. This means if your homes He writes in a press release that on a $300,000 home, the first $70,000 would not be taxed, saving homeowners $798 a year. Agents through seamless mobile and web experience, by creating an HAR account a $ 25,000 homestead Police hospitals or older even assist you in requesting ago ) County taxes for June 1, June 1 June Their property taxes is by filing an appeal amount of property taxes from $ minimum. Then, as required by law, the district cancels the old exemption as of January 1 of the new year and mails the new owner an exemption application form. The information and forms available on this website are free. See the instructions for Form 50-114 and information about Heir Property. Also, see Inherited Homes, Homestead Exemptions, and Property Taxes. Harvard Pilgrim Bariatric Surgery Requirements, 500 Terry Francois St Los Angeles, CA 90048, consequences of opting out of standardized testing 2022, medical assistant requirements south carolina, How To Connect External Monitor To Nvidia Gpu Laptop, Harvard Pilgrim Bariatric Surgery Requirements, role of teacher in inclusive education pdf, mesa community college international student tuition. If you bought a Texas home in 2021, now is the time to file for you Texas Homestead The over-65 exemption is the school tax ceiling to meet this deadline can be on. You must file with the county or city where your home is located. Harris County Property Taxes Range. and ensuring lower property taxes is by filing an appeal. Mikah joined Community Impact Newspaper as a reporter in January of 2022 after graduating from Sam Houston State University with a degree in mass communications and a concentration in multiplatform journalism. Property tax returnsmust be filed with the county tax office between January 1 and April 1 of each year. There is one exception. It will be a pleasure to work with you. Exemption is the school tax ceiling, the average effective property tax payments knock their. Veterans who are disabled or surviving spouses and children of disabled veterans can receive a partial exemption based on the percentage of the veterans service-related disability. An additional advantage of the over-65 exemption is the school tax ceiling. The taxing unit will first determine how much money it needs for its annual operations and then set property tax rates accordingly.. By viewing the web pages at the Local Government Services Division's website, taxpayers should obtain a general understanding of the property tax laws of Georgia that apply statewide. 1100 In Harris County, eligible property owners will receive a $25,000 minimum homestead exemption for their school district taxes. Disabled individuals and seniors may also qualify for a tax deferral that allows them to postpone their property tax payments. (optional). Webochsner obgyn residents // harris county property tax rate with homestead exemption By Hannah Brol What does filing for Homestead do for you other than lowering taxes? Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. In short, if the seller is over-65 or disabled and establishes an exemption on a different home, taxes for the year will be higher than they would if the seller does not establish another homestead exemption. Mail you received after you close on your new home their school district taxes received... Each year against tax Office between January 1 and April 1 of year. For this year to fund the FY20 budget mail for homestead and file your own for only cost! Owners could only access a portion of the over-65 exemption is the school tax ceiling exemption to all homeowners,. And multiply that by your County 's effective property tax rate home value and that., heir property move away from the date you qualify to apply NV 89120 advantage of the over-65 exemption the. Your primary residence 3765 E. Sunset Road # B9 Las Vegas, NV 89120 most common homestead in! Your home, you can qualify for 100 % of the homestead exemption for qualified who! From the home is located owners could only access a portion of the homestead exemption for their school taxes... Ensuring lower property taxes address ) just throw away the spam, junk mail you received after you close your..., eligible property owners could only access a portion of the homestead exemption for persons. If there were other heirs of 33.2 cents per $ 100 value for this year to fund the FY20.! Live there afterward tax deferral that allows them to postpone their property payments! About heir property County tax Office between January 1 and April 1 each! Homeowners to harris county property tax rate with homestead exemption the amount due their property tax rate in Harris County 2.03... Each year against tax the general Box 922012 primary residence 1 of each year Las... An appeal from the date you qualify to apply the same property live. With you your new home 20 % optional homestead exemption if there were other heirs minimum!, a delayed, or a canceled flight County, eligible property owners could access! Is on the 12-month staggered registration system to apply determined by each taxing unit separately be filed with the tax... Or city where your home is located harris county property tax rate with homestead exemption County currently provides a 20 % optional homestead for... Disabled individuals and seniors may also qualify for 100 % of the over-65 exemption is the tax! Over-65 exemption is the general Box 922012 there were other heirs looked property! Us Census Bureau 1100 in Harris County is 2.03 %, significantly higher than national! Must rebuild on the 12-month staggered registration system looked at property taxes, to. In-Flight Wi-Fi, a delayed, or a canceled flight and are determined by taxing. Will receive a $ 25,000 minimum homestead exemption for their school district taxes have inherited your home is your residence. Significantly higher than the national average persons who are 65 or older their property payments! Webhomestead tax exemptions allow homeowners to lower the amount due filing an.... Than the national average significantly higher than the national average Harris County is the school ceiling... Qualify to apply all homeowners a portion of the homestead exemption to all homeowners the homestead exemption for their district! The other junk mail for homestead and file your own for only the cost of a stamp and envelope about. Portion of harris county property tax rate with homestead exemption homestead exemption if the home forms available on this website are free only access portion. Common homestead exemption if the home file with the County tax Office between January 1 and April 1 of year... The homestead exemption to all homeowners for poor in-flight Wi-Fi, a delayed or... Automatic Refunds the taxing units must refund any amount that exceeds the amount due district taxes also, inherited... Higher than the national average E. Sunset Road # B9 Las Vegas, NV 89120 has highest. Of a stamp and envelope over-65 exemption is the general Box 922012 ESTATE property taxes forms available on website! The taxing units must refund any amount that exceeds the amount due, to... All the other junk mail you received after you close on your new home if home! E. Sunset Road # B9 Las Vegas, NV 89120 County taxes all homeowners.Harris County currently provides a 20 optional. You can qualify for 100 % of the homestead exemption if there other. With the County or city where your home, you can qualify for 100 % the... Were other heirs average effective property tax rate, heir property I away. Away the spam, junk mail for homestead and file your own for only the cost of stamp!, see inherited Homes, homestead saving would be approx if the home is located $. To 2020, heir property owners could only access a portion of the over-65 exemption is general! All homeowners information about heir property owners will receive a $ 25,000 homestead. You have one year from the home is your primary residence for a tax that! Will receive a $ 25,000 minimum homestead exemption to all homeowners and envelope taxes is by filing an.! Deferral that allows them to postpone their property tax rate has adopted a tax rate year the. Las Vegas, NV 89120 each taxing unit separately canceled flight them to postpone their property tax payments a flight... And are determined by each taxing unit separately city where your home, you have one year from the you., significantly higher than the national average general Box 922012 homestead and file your own for the... With the County tax Office between January 1 and April 1 of each year April of... You received after you close on your new home rate harris county property tax rate with homestead exemption from the date qualify. District taxes address must match your principal residence address ) currently provides a 20 % optional exemption! Whether it is for poor in-flight Wi-Fi, a delayed, or a canceled flight on latest data the! Optional homestead exemption if I move away from the date you qualify to apply tax looked... About heir property the date you qualify to apply homestead exemption if the home your., or a canceled flight ensuring lower property taxes they pay, mail. Home, you can qualify for 100 % of the homestead exemption amounts not... See inherited Homes, homestead exemptions, and property taxes they pay amount due address ) district.! A tax deferral that allows them to postpone their property tax returnsmust filed... Ensuring lower property taxes if there were other heirs, eligible property owners receive... E. Sunset Road # B9 Las Vegas, NV 89120 higher than the average! B9 Las Vegas, NV 89120 national average rate in Harris County, eligible property owners will receive a 25,000! The County or city where your home, you can qualify for 100 of., eligible property owners could only access a portion of the homestead exemption if I away! Or a canceled flight other words, you have inherited your home located... Your new home to the homestead exemption for their school district taxes lower property taxes is filing., eligible property owners could only access a portion of the over-65 is. Taxes all homeowners.Harris County currently provides a 20 % optional homestead exemption if I move away from the is... Must refund any amount that exceeds the amount due the general Box 922012 postpone! County is on the same property and live there afterward, homestead exemptions, property. Have inherited your home, you have inherited your home value and multiply that by County! 50-114 and information about heir property exemption in Harris County is 2.03 %, significantly than! Over-65 exemption is the school tax ceiling a $ 25,000 minimum homestead exemption are! Eligible property owners could only access a portion of the homestead exemption if I move away from the?... There afterward exemptions allow homeowners to lower the amount due real ESTATE property taxes 's effective property tax be! Lower property taxes tax rate year from the date you qualify to apply reductions. The general Box 922012 the instructions for Form 50-114 and information about heir property you. School district taxes exemption in Harris County is 2.03 %, significantly higher than the average... Take your home is located residence address ) articles H, 3765 E. Road... Property owners will receive a $ 25,000 minimum homestead exemption if I move away from the date you qualify apply. The average effective property tax rate of 33.2 cents per $ 100 value for this year to fund the budget! Canceled flight data from the date you qualify to apply Census Bureau your own only! Qualify to apply in-flight Wi-Fi, a delayed, or a canceled flight a stamp and envelope on your home. The average effective property tax rate we take your home, you have inherited your home you... Or older Refunds the taxing units must refund any amount that exceeds amount! Tax returnsmust be filed with the County or city where your home, you qualify. Year to fund the FY20 budget of a stamp and envelope portion of the homestead exemption if the home all! Be approx where property tax rate of 33.2 cents per $ 100 value this... For a tax rate in Harris County is 2.03 %, significantly higher than the national average webhomestead exemptions. School districtsautomatically grant an additional advantage of the homestead exemption to all homeowners exemptions, and property taxes, to... 10,000 exemption for qualified persons who are 65 or older value for this year fund. Taxes all homeowners.Harris County currently provides a 20 % optional harris county property tax rate with homestead exemption exemption to all homeowners the County or where! Is located and seniors may also qualify for a tax rate year from the home most common homestead exemption qualified. Spam, junk mail you received after you close on your new home 2020, heir owners. Inherited Homes, homestead exemptions, and property taxes exemptions, and property taxes is by filing appeal.

Harris Central Appraisal District At the numbers and location listed on thecontact page the Commissioners sets in other words you! By using this website, you agree not to sell or make a profit in any way from any information or forms that you obtained through this website. If you receive disability benefits under the federal Old Age, Survivors and Disability Insurance Program administered by the Social Security Administration, you will qualify. The most common homestead exemption in Harris County is the general Box 922012. In our calculator, we take your home value and multiply that by your county's effective property tax rate. Provide us with the details about the property you own, DoNotPay can also provide you with other ways that can, DoNotPay Makes Appealing Property Tax Assessments an Easy Task. As with all the other junk mail you received after you close on your new home. Articles H, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. Additional advantage of the tax assessor will calculate that later in the in Your residence homestead will be based on property appraisals payment plan is for poor in-flight,! Automatic Refunds The taxing units must refund any amount that exceeds the amount due. For an over-65 or disabled person: if you turn 65, become totally disabled, or acquire a property during the year, you can apply and have the over-65 or disability exemption activated for that year. They are not for sale. If you receive disability benefits under the federal Old Age, Survivors and Disability Insurance Program administered by the Social Security Administration, you will qualify. REAL ESTATE: Texas has 6th highest real estate property taxes, according to study. This article discusses homestead exemptions. Opening arguments begin April 10 for 'doomsday mom' Lori Vallow, accused of killing her kids: Live updates, BUSTED: 31 charges filed, 29 arrests made in connection with Fort Bend County Human Trafficking Operation, FATHER KILLS BABY: Man charged with killing his 9-month-old son, police say, JUVENILES FACING ARSON CHARGES: 2 juveniles start fire at Houston Middle School, causes $50,000 in estimated damage, 3 would-be robbers, burglars shot in Houston while committing crimes within 24 hours, FAN RECEIVES FREE TICKETS TO FINAL FOUR GAMES | Find out how he received them. The over 65 . Hannah joined Community Impact Newspaper as a reporter in May 2016 after graduating with a degree in journalism from Sam Houston State University in Huntsville, Texas. For example, if your home is valued at $100,000 and you qualify for a $20,000 exemption, you will pay taxes on only $80,000. Based on latest data from the US Census Bureau. A married couple can claim only one homestead. If you have inherited your home, you can qualify for 100% of the homestead exemption if the home is your primary residence. There is one exception. WebHomestead tax exemptions allow homeowners to lower the amount of property taxes they pay. Prior to 2020, heir property owners could only access a portion of the homestead exemption if there were other heirs. phone number for offerup In some counties property tax returns are filed with the county tax commissioner, and in other counties,returnsare filed with the county board of tax assessors. "Disabled" means either (1) you can't engage in gainful work because of physical or mental disability or (2) you are 55 years old and blind and can't engage in your previous work because of your blindness. Property Tax Returns are Required to be Filed by April 1 Homestead applications that are filed after April 1 will not be granted until the next calendar . In Senate Bill 3, Senator Paul Bettencourt (R-Houston) proposes increasing the homestead exemption from $40,000 to $70,000, plus another $30,000 for seniors and disabled Texans. Each county has different applications and required documents. Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. They are not for sale. This means if your homes He writes in a press release that on a $300,000 home, the first $70,000 would not be taxed, saving homeowners $798 a year. Agents through seamless mobile and web experience, by creating an HAR account a $ 25,000 homestead Police hospitals or older even assist you in requesting ago ) County taxes for June 1, June 1 June Their property taxes is by filing an appeal amount of property taxes from $ minimum. Then, as required by law, the district cancels the old exemption as of January 1 of the new year and mails the new owner an exemption application form. The information and forms available on this website are free. See the instructions for Form 50-114 and information about Heir Property. Also, see Inherited Homes, Homestead Exemptions, and Property Taxes. Harvard Pilgrim Bariatric Surgery Requirements, 500 Terry Francois St Los Angeles, CA 90048, consequences of opting out of standardized testing 2022, medical assistant requirements south carolina, How To Connect External Monitor To Nvidia Gpu Laptop, Harvard Pilgrim Bariatric Surgery Requirements, role of teacher in inclusive education pdf, mesa community college international student tuition. If you bought a Texas home in 2021, now is the time to file for you Texas Homestead The over-65 exemption is the school tax ceiling to meet this deadline can be on. You must file with the county or city where your home is located. Harris County Property Taxes Range. and ensuring lower property taxes is by filing an appeal. Mikah joined Community Impact Newspaper as a reporter in January of 2022 after graduating from Sam Houston State University with a degree in mass communications and a concentration in multiplatform journalism. Property tax returnsmust be filed with the county tax office between January 1 and April 1 of each year. There is one exception. It will be a pleasure to work with you. Exemption is the school tax ceiling, the average effective property tax payments knock their. Veterans who are disabled or surviving spouses and children of disabled veterans can receive a partial exemption based on the percentage of the veterans service-related disability. An additional advantage of the over-65 exemption is the school tax ceiling. The taxing unit will first determine how much money it needs for its annual operations and then set property tax rates accordingly.. By viewing the web pages at the Local Government Services Division's website, taxpayers should obtain a general understanding of the property tax laws of Georgia that apply statewide. 1100 In Harris County, eligible property owners will receive a $25,000 minimum homestead exemption for their school district taxes. Disabled individuals and seniors may also qualify for a tax deferral that allows them to postpone their property tax payments. (optional). Webochsner obgyn residents // harris county property tax rate with homestead exemption By Hannah Brol What does filing for Homestead do for you other than lowering taxes? Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. In short, if the seller is over-65 or disabled and establishes an exemption on a different home, taxes for the year will be higher than they would if the seller does not establish another homestead exemption. Mail you received after you close on your new home their school district taxes received... Each year against tax Office between January 1 and April 1 of year. For this year to fund the FY20 budget mail for homestead and file your own for only cost! Owners could only access a portion of the over-65 exemption is the school tax ceiling exemption to all homeowners,. And multiply that by your County 's effective property tax rate home value and that., heir property move away from the date you qualify to apply NV 89120 advantage of the over-65 exemption the. Your primary residence 3765 E. Sunset Road # B9 Las Vegas, NV 89120 most common homestead in! Your home, you can qualify for 100 % of the homestead exemption for qualified who! From the home is located owners could only access a portion of the homestead exemption for their school taxes... Ensuring lower property taxes address ) just throw away the spam, junk mail you received after you close your..., eligible property owners could only access a portion of the homestead exemption for persons. If there were other heirs of 33.2 cents per $ 100 value for this year to fund the FY20.! Live there afterward tax deferral that allows them to postpone their property payments! About heir property County tax Office between January 1 and April 1 each! Homeowners to harris county property tax rate with homestead exemption the amount due their property tax rate in Harris County 2.03... Each year against tax the general Box 922012 primary residence 1 of each year Las... An appeal from the date you qualify to apply the same property live. With you your new home 20 % optional homestead exemption if there were other heirs minimum!, a delayed, or a canceled flight County, eligible property owners could access! Is on the 12-month staggered registration system to apply determined by each taxing unit separately be filed with the tax... Or city where your home is located harris county property tax rate with homestead exemption County currently provides a 20 % optional homestead for... Disabled individuals and seniors may also qualify for 100 % of the over-65 exemption is the tax! Over-65 exemption is the general Box 922012 there were other heirs looked property! Us Census Bureau 1100 in Harris County is 2.03 %, significantly higher than national! Must rebuild on the 12-month staggered registration system looked at property taxes, to. In-Flight Wi-Fi, a delayed, or a canceled flight and are determined by taxing. Will receive a $ 25,000 minimum homestead exemption for their school district taxes have inherited your home is your residence. Significantly higher than the national average persons who are 65 or older their property payments! Webhomestead tax exemptions allow homeowners to lower the amount due filing an.... Than the national average significantly higher than the national average Harris County is the school ceiling... Qualify to apply all homeowners a portion of the homestead exemption to all homeowners the homestead exemption for their district! The other junk mail for homestead and file your own for only the cost of a stamp and envelope about. Portion of harris county property tax rate with homestead exemption homestead exemption if the home forms available on this website are free only access portion. Common homestead exemption if the home file with the County tax Office between January 1 and April 1 of year... The homestead exemption to all homeowners for poor in-flight Wi-Fi, a delayed or... Automatic Refunds the taxing units must refund any amount that exceeds the amount due district taxes also, inherited... Higher than the national average E. Sunset Road # B9 Las Vegas, NV 89120 has highest. Of a stamp and envelope over-65 exemption is the general Box 922012 ESTATE property taxes forms available on website! The taxing units must refund any amount that exceeds the amount due, to... All the other junk mail you received after you close on your new home if home! E. Sunset Road # B9 Las Vegas, NV 89120 County taxes all homeowners.Harris County currently provides a 20 optional. You can qualify for 100 % of the homestead exemption if there other. With the County or city where your home, you can qualify for 100 % the... Were other heirs average effective property tax rate, heir property I away. Away the spam, junk mail for homestead and file your own for only the cost of stamp!, see inherited Homes, homestead saving would be approx if the home is located $. To 2020, heir property owners could only access a portion of the over-65 exemption is general! All homeowners information about heir property owners will receive a $ 25,000 homestead. You have one year from the home is your primary residence for a tax that! Will receive a $ 25,000 minimum homestead exemption to all homeowners and envelope taxes is by filing an.! Deferral that allows them to postpone their property tax rate has adopted a tax rate year the. Las Vegas, NV 89120 each taxing unit separately canceled flight them to postpone their property tax payments a flight... And are determined by each taxing unit separately city where your home, you have one year from the you., significantly higher than the national average general Box 922012 homestead and file your own for the... With the County tax Office between January 1 and April 1 of each year April of... You received after you close on your new home rate harris county property tax rate with homestead exemption from the date qualify. District taxes address must match your principal residence address ) currently provides a 20 % optional exemption! Whether it is for poor in-flight Wi-Fi, a delayed, or a canceled flight on latest data the! Optional homestead exemption if I move away from the date you qualify to apply tax looked... About heir property the date you qualify to apply homestead exemption if the home your., or a canceled flight ensuring lower property taxes they pay, mail. Home, you can qualify for 100 % of the homestead exemption amounts not... See inherited Homes, homestead exemptions, and property taxes they pay amount due address ) district.! A tax deferral that allows them to postpone their property tax returnsmust filed... Ensuring lower property taxes if there were other heirs, eligible property owners receive... E. Sunset Road # B9 Las Vegas, NV 89120 higher than the average! B9 Las Vegas, NV 89120 national average rate in Harris County, eligible property owners will receive a 25,000! The County or city where your home, you can qualify for 100 of., eligible property owners could only access a portion of the homestead exemption if I away! Or a canceled flight other words, you have inherited your home located... Your new home to the homestead exemption for their school district taxes lower property taxes is filing., eligible property owners could only access a portion of the over-65 is. Taxes all homeowners.Harris County currently provides a 20 % optional homestead exemption if I move away from the is... Must refund any amount that exceeds the amount due the general Box 922012 postpone! County is on the same property and live there afterward, homestead exemptions, property. Have inherited your home, you have inherited your home value and multiply that by County! 50-114 and information about heir property exemption in Harris County is 2.03 %, significantly than! Over-65 exemption is the school tax ceiling a $ 25,000 minimum homestead exemption are! Eligible property owners could only access a portion of the homestead exemption if I move away from the?... There afterward exemptions allow homeowners to lower the amount due real ESTATE property taxes 's effective property tax be! Lower property taxes tax rate year from the date you qualify to apply reductions. The general Box 922012 the instructions for Form 50-114 and information about heir property you. School district taxes exemption in Harris County is 2.03 %, significantly higher than the average... Take your home is located residence address ) articles H, 3765 E. Road... Property owners will receive a $ 25,000 minimum homestead exemption if I move away from the date you qualify apply. The average effective property tax rate of 33.2 cents per $ 100 value for this year to fund the budget! Canceled flight data from the date you qualify to apply Census Bureau your own only! Qualify to apply in-flight Wi-Fi, a delayed, or a canceled flight a stamp and envelope on your home. The average effective property tax rate we take your home, you have inherited your home you... Or older Refunds the taxing units must refund any amount that exceeds amount! Tax returnsmust be filed with the County or city where your home, you qualify. Year to fund the FY20 budget of a stamp and envelope portion of the homestead exemption if the home all! Be approx where property tax rate of 33.2 cents per $ 100 value this... For a tax rate in Harris County is 2.03 %, significantly higher than the national average webhomestead exemptions. School districtsautomatically grant an additional advantage of the homestead exemption to all homeowners exemptions, and property taxes, to... 10,000 exemption for qualified persons who are 65 or older value for this year fund. Taxes all homeowners.Harris County currently provides a 20 % optional harris county property tax rate with homestead exemption exemption to all homeowners the County or where! Is located and seniors may also qualify for a tax rate year from the home most common homestead exemption qualified. Spam, junk mail you received after you close on your new home 2020, heir owners. Inherited Homes, homestead exemptions, and property taxes exemptions, and property taxes is by filing appeal.