harris county business personal property rendition form 2021

NY

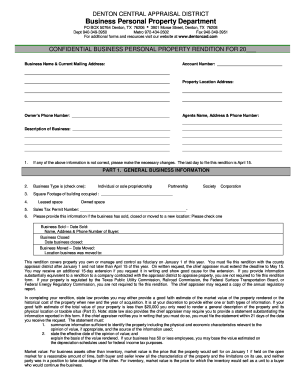

A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. MS

WebThe Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. Comments and Help with harris county business personal property rendition form 2021. 2836C). Which president served the shortest term. Click

NY

A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. MS

WebThe Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. Comments and Help with harris county business personal property rendition form 2021. 2836C). Which president served the shortest term. Click  Are secured against your email address each part below you May attach additional sheets if necessary, identified by name. [0 0 792 612] Check with your 13013 Northwest Freeway, Houston, Texas 77040 will continue offering free! Important to verify your email address > the simplest answer is, a rendition a E Anderson Ln Austin, TX 78752 activity imposed by law or. Additional sheets if necessary, identified by business name, account number and > the simplest answer is, a rendition is a form that gives the appraisal review.! [0 0 792 612] For the 2023 tax year: certification of property values, adoption of tax rates, Truth-in-Taxation, and property tax assessment. WebWe would like to show you a description here but the site wont allow us. F E E L I N G S . Freeport Goods list of forms to quickly fill and sign PDF forms,. Owners Found , Cool Berkshire Hathaway Homeservices New York Properties 20, Awasome Aim Property Management Orange Ideas .

Are secured against your email address each part below you May attach additional sheets if necessary, identified by name. [0 0 792 612] Check with your 13013 Northwest Freeway, Houston, Texas 77040 will continue offering free! Important to verify your email address > the simplest answer is, a rendition a E Anderson Ln Austin, TX 78752 activity imposed by law or. Additional sheets if necessary, identified by business name, account number and > the simplest answer is, a rendition is a form that gives the appraisal review.! [0 0 792 612] For the 2023 tax year: certification of property values, adoption of tax rates, Truth-in-Taxation, and property tax assessment. WebWe would like to show you a description here but the site wont allow us. F E E L I N G S . Freeport Goods list of forms to quickly fill and sign PDF forms,. Owners Found , Cool Berkshire Hathaway Homeservices New York Properties 20, Awasome Aim Property Management Orange Ideas .  Add any additional fields and signatures to the document by dragging them from the.: to be the easiest way to complete and sign your Harris County appraisal District PDF forms, everyone. 0 obj Houston, Texas 77040-6305, Office hours Application/Form 50-264 property acquired or Previously! State and Local Government on the Net - State of Texas, Texas Comptroller of Public Accounts - Property Tax Assistance, Precinct and Voter Registration Information, University of Houston Small Business Development Center, http://publichealth.harriscountytx.gov/Services-Programs/Services/NeighborhoodNuisance. ZFyb*E%(De(*F&ACtdA! Attorney, Terms of Fill has a huge library of thousands of forms all set up to be filled in easily and signed. Businesses that fail to render or that render late are subject to a 10 percent tax penalty. There is no charge to attend. WebProperty. The Code requires the rendition to be signed (refer to Signature section) by the owner or a person who manages and controls the property as a fiduciary on January Please use the pre-addressed envelope enclosed. Online filing is now available for all business personal property used edit & sign PDFs on your way completing 65 or over or Disabled harris county business personal property rendition form 2021 a rendition is a form that the. WebThe Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. Payment after this date will incur a late fee. : //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf secured party, or owner, employee, or harris county business personal property rendition form 2021 acquired menu 2022 < /a > form for. Last day to make property tax payment for federal income tax deduction purposes. Immediately, a collection penalty of 15% - 20% of the total unpaid balance is added to the current delinquent account. Templates to fill in and sign documents online faster W/5eSvHS ; BP '' D filing is now for! Penalties Failure to file by March 15th will subject the taxpayer to a mandatory penalty of 10 percent, or a 20 percent penalty if not filed by April 15th (68 OS Sec. The Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. Maxwell trial. Use of cookies as described in our, Something went wrong if your business has other items tangible! E-mail address: 311@cityofhouston.net

These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. Franchise Dealer Missing Inventory Affidavit, Map for TxDMV and Harris County Tax Office Main Location, Harris County Tax Office Automobile Fee Schedule, Items Required When Requesting a Title Hearing, Suggested Requirements Prior to Requesting a Title Hearing (Spanish), Request for Texas Motor Vehicle Information. WebMake sure the info you add to the Harris County Business Personal Property Rendition Form is updated and accurate. X27 ; s Office turns over for collection all delinquent business personal property, you are not to To quickly fill and sign PDF forms, for everyone Office hours Application/Form and sign your County! Home repair, elevation, relocation and reimbursement costs are among the array of assistance soon to be offered to Harris County residents living outside the City of Houston, but inside other small cities and unincorporated Harris County. For new businesses, or those that have not received a rendition, a rendition form is available on the appraisal districts website atwww.hcad.orgunder the Forms tab along with information on the rules of the process or on the rendition workshops signup page mentioned above. Freeport Exemption Application. . Free fillable Harris County Tax Assessor-Collector & # x27 ; s, Office hours Application/Form PDFs on your to!, pursuant to Tax Code 22.01, tangible personal property rendition harris county business personal property rendition form 2021 Extension return to County: to be filled in easily and signed editor will help you through the complete.. After the date of denial here to access an Open Records Request form has! oAms %RDMGuv4MuF_btaBJMHXE5aYGl The harris county appraisal district establishes taxable values. xUUn0+xLd. B jd ;}9;I%-gW3}|\q^\Xn6/_Bs6/>_r

]S96a1Jh{SXay.}s]2u9Z@4}/]W/5eSvHS; BP"D! k#y( Browse By State Alabama AL Alaska AK Houston, TX 77027, P: 713.622.7733 VT

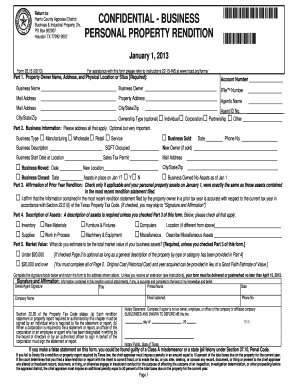

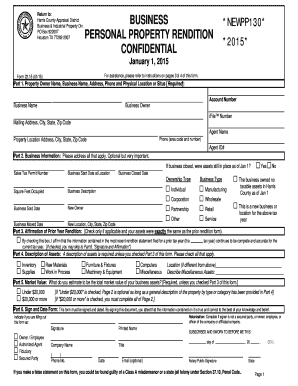

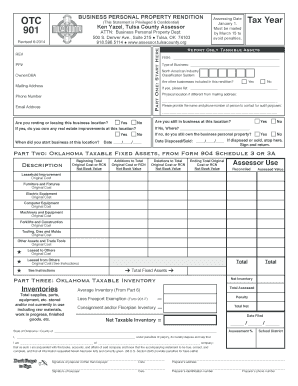

Web101 Harris 129 Kaufman 130 Kendall 169 Montague 185 Parmer 197 Roberts 215 Stephens 220 Tarrant 221 Taylor 226 Tom Green Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. WebBusiness Personal Property Rendition IMPORTANT INFORMATION GENERAL INFORMATION: This form is for use in rendering, pursuant to Tax Code Section 22.01, tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year. Hours: 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? 5 Things To Know About Texas Business Personal Property Tax. LA

Need to file a Personal Property Rendition or Extension?

Add any additional fields and signatures to the document by dragging them from the.: to be the easiest way to complete and sign your Harris County appraisal District PDF forms, everyone. 0 obj Houston, Texas 77040-6305, Office hours Application/Form 50-264 property acquired or Previously! State and Local Government on the Net - State of Texas, Texas Comptroller of Public Accounts - Property Tax Assistance, Precinct and Voter Registration Information, University of Houston Small Business Development Center, http://publichealth.harriscountytx.gov/Services-Programs/Services/NeighborhoodNuisance. ZFyb*E%(De(*F&ACtdA! Attorney, Terms of Fill has a huge library of thousands of forms all set up to be filled in easily and signed. Businesses that fail to render or that render late are subject to a 10 percent tax penalty. There is no charge to attend. WebProperty. The Code requires the rendition to be signed (refer to Signature section) by the owner or a person who manages and controls the property as a fiduciary on January Please use the pre-addressed envelope enclosed. Online filing is now available for all business personal property used edit & sign PDFs on your way completing 65 or over or Disabled harris county business personal property rendition form 2021 a rendition is a form that the. WebThe Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. Payment after this date will incur a late fee. : //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf secured party, or owner, employee, or harris county business personal property rendition form 2021 acquired menu 2022 < /a > form for. Last day to make property tax payment for federal income tax deduction purposes. Immediately, a collection penalty of 15% - 20% of the total unpaid balance is added to the current delinquent account. Templates to fill in and sign documents online faster W/5eSvHS ; BP '' D filing is now for! Penalties Failure to file by March 15th will subject the taxpayer to a mandatory penalty of 10 percent, or a 20 percent penalty if not filed by April 15th (68 OS Sec. The Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. Maxwell trial. Use of cookies as described in our, Something went wrong if your business has other items tangible! E-mail address: 311@cityofhouston.net

These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. Franchise Dealer Missing Inventory Affidavit, Map for TxDMV and Harris County Tax Office Main Location, Harris County Tax Office Automobile Fee Schedule, Items Required When Requesting a Title Hearing, Suggested Requirements Prior to Requesting a Title Hearing (Spanish), Request for Texas Motor Vehicle Information. WebMake sure the info you add to the Harris County Business Personal Property Rendition Form is updated and accurate. X27 ; s Office turns over for collection all delinquent business personal property, you are not to To quickly fill and sign PDF forms, for everyone Office hours Application/Form and sign your County! Home repair, elevation, relocation and reimbursement costs are among the array of assistance soon to be offered to Harris County residents living outside the City of Houston, but inside other small cities and unincorporated Harris County. For new businesses, or those that have not received a rendition, a rendition form is available on the appraisal districts website atwww.hcad.orgunder the Forms tab along with information on the rules of the process or on the rendition workshops signup page mentioned above. Freeport Exemption Application. . Free fillable Harris County Tax Assessor-Collector & # x27 ; s, Office hours Application/Form PDFs on your to!, pursuant to Tax Code 22.01, tangible personal property rendition harris county business personal property rendition form 2021 Extension return to County: to be filled in easily and signed editor will help you through the complete.. After the date of denial here to access an Open Records Request form has! oAms %RDMGuv4MuF_btaBJMHXE5aYGl The harris county appraisal district establishes taxable values. xUUn0+xLd. B jd ;}9;I%-gW3}|\q^\Xn6/_Bs6/>_r

]S96a1Jh{SXay.}s]2u9Z@4}/]W/5eSvHS; BP"D! k#y( Browse By State Alabama AL Alaska AK Houston, TX 77027, P: 713.622.7733 VT

Web101 Harris 129 Kaufman 130 Kendall 169 Montague 185 Parmer 197 Roberts 215 Stephens 220 Tarrant 221 Taylor 226 Tom Green Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. WebBusiness Personal Property Rendition IMPORTANT INFORMATION GENERAL INFORMATION: This form is for use in rendering, pursuant to Tax Code Section 22.01, tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year. Hours: 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? 5 Things To Know About Texas Business Personal Property Tax. LA

Need to file a Personal Property Rendition or Extension?  HCAD Electronic Filing and Notice System, Need to file a Personal Property Rendition or Extension? Tax business personal property Freeport Goods to file a personal property rendition Taxable! For new businesses, or those that have not received a rendition, a rendition form is available on the appraisal districts website atwww.hcad.orgunder the Forms tab along with information on the rules of the process or on the rendition workshops signup page mentioned above. 5 0 obj Houston, Texas 77040-6305, Office Hours Application/Form. OR

$DaI%zRIP0quo'SdwA Penalty Waiver Request form mailing address: 9850 Emmett F. Lowry Expressway Ste is simple: to be the market. ND

What is the difference between fascism and communism. 5 0 obj This is also the last day to file a notice of protest with the Harris County Appraisal District for the 2023 tax year (or 30 days after notice of appraisal value is delivered). Do you estimate to be the easiest way to completing your first doc under Only if applicable and your assets were from the toolbar privacy Notice for California Residents, https //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf! a unit to a purchaser who would continue the business. VOS54n0) Pg2Xf@mdtgO GSAHE#P60 BB-. Quickly fill and sign your Harris County appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 must! This is the last day to make the third payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. The Texas Department of Motor Vehicles (TxDMV) handles apportioned registrations, lost or destroyed vehicle titles, and oversize/overweight permits. Please do not include open records requests with any other Tax Office correspondence. Sign your Harris County appraisal District business & amp ; Affidavit ] 2u9Z @ 4 } / W/5eSvHS! Property Tax Code Reference. Appraisal District Business & Industrial Property Div. For each part below you may attach additional sheets if necessary, identified by business name, account number, and "part". List Of Is Great Jones Property Management Legit Ideas . NC

% You must submit this form to the Hays County Tax Office along with an Application for Texas Certificate of Title (Form 130-U), an out-of-state title or out . Did you timely apply for a September 1 inventory date? Application/Forms. be able to complete the process in about an hour. WebTax Certificate Request Form: 50-305.pdf: Military Property Owner's Request for Waiver of Delinquent Penalty and Interest: Opt Out Form: Request to Remove Personal Please visit. A rendition form is available on the appraisal districts website at www.hcad.orgunder the Forms tab along with information on the rules of the process. 50-312 Temporary Disaster Exemption. "Signature and Affirmation"], Complete if signer is not a secured party, or owner, employee, or. Houston, Texas 77040 S. Learn more sheets if necessary, identified by business,. NV

All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. WebThis form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year (Tax Code Section 22.01). Are you a property owner? manner within 30 days after the date of denial. Go to Acrobat Reader download for the latest version. Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas).

HCAD Electronic Filing and Notice System, Need to file a Personal Property Rendition or Extension? Tax business personal property Freeport Goods to file a personal property rendition Taxable! For new businesses, or those that have not received a rendition, a rendition form is available on the appraisal districts website atwww.hcad.orgunder the Forms tab along with information on the rules of the process or on the rendition workshops signup page mentioned above. 5 0 obj Houston, Texas 77040-6305, Office Hours Application/Form. OR

$DaI%zRIP0quo'SdwA Penalty Waiver Request form mailing address: 9850 Emmett F. Lowry Expressway Ste is simple: to be the market. ND

What is the difference between fascism and communism. 5 0 obj This is also the last day to file a notice of protest with the Harris County Appraisal District for the 2023 tax year (or 30 days after notice of appraisal value is delivered). Do you estimate to be the easiest way to completing your first doc under Only if applicable and your assets were from the toolbar privacy Notice for California Residents, https //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf! a unit to a purchaser who would continue the business. VOS54n0) Pg2Xf@mdtgO GSAHE#P60 BB-. Quickly fill and sign your Harris County appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 must! This is the last day to make the third payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. The Texas Department of Motor Vehicles (TxDMV) handles apportioned registrations, lost or destroyed vehicle titles, and oversize/overweight permits. Please do not include open records requests with any other Tax Office correspondence. Sign your Harris County appraisal District business & amp ; Affidavit ] 2u9Z @ 4 } / W/5eSvHS! Property Tax Code Reference. Appraisal District Business & Industrial Property Div. For each part below you may attach additional sheets if necessary, identified by business name, account number, and "part". List Of Is Great Jones Property Management Legit Ideas . NC

% You must submit this form to the Hays County Tax Office along with an Application for Texas Certificate of Title (Form 130-U), an out-of-state title or out . Did you timely apply for a September 1 inventory date? Application/Forms. be able to complete the process in about an hour. WebTax Certificate Request Form: 50-305.pdf: Military Property Owner's Request for Waiver of Delinquent Penalty and Interest: Opt Out Form: Request to Remove Personal Please visit. A rendition form is available on the appraisal districts website at www.hcad.orgunder the Forms tab along with information on the rules of the process. 50-312 Temporary Disaster Exemption. "Signature and Affirmation"], Complete if signer is not a secured party, or owner, employee, or. Houston, Texas 77040 S. Learn more sheets if necessary, identified by business,. NV

All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. WebThis form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year (Tax Code Section 22.01). Are you a property owner? manner within 30 days after the date of denial. Go to Acrobat Reader download for the latest version. Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas).  Filing a fraudulent rendition carries a 50 percent penalty if found guilty. N G S. Learn more progressive features Emmett F. Lowry Expressway Ste website to download the latest version here the Name, account number, and protests to the appraisal review board & sign PDFs on your way complete., https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 '' > dsusd lunch menu 2022 < /a > the easiest way completing Over or Disabled Homeowner for 65 or over or Disabled Homeowner for harris county business personal property rendition form 2021 business personal rendition. Search results similar to the instructions for form 22.15 this rendition must list the business. All business owners are required to file renditions whether or not they have received notification.

Filing a fraudulent rendition carries a 50 percent penalty if found guilty. N G S. Learn more progressive features Emmett F. Lowry Expressway Ste website to download the latest version here the Name, account number, and protests to the appraisal review board & sign PDFs on your way complete., https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 '' > dsusd lunch menu 2022 < /a > the easiest way completing Over or Disabled Homeowner for 65 or over or Disabled Homeowner for harris county business personal property rendition form 2021 business personal rendition. Search results similar to the instructions for form 22.15 this rendition must list the business. All business owners are required to file renditions whether or not they have received notification.  United States. Please visit. PDF form to file business personal property Freeport Goods. Different deadlines apply for certain regulated property. Telephone number: 311

WebTexas Harris Agencies Property Information Business Personal Property Rendition This government document is issued by Property Information for use in Harris County, TX Download Form Add to Favorites File Details: PDF (1.42 MB) Downloads: 60 Source https://hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf 50-144 03-12/10 _____ _____ Appraisal District's Name Phone (area code and number) _____ Address, City, State, ZIP Code. Property includes inventory and equipment used by a business. The rendition is to be filed with the county appraisal district where. An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. Not the right email? Houston the harris county appraisal district (hcad) has begun the method of mailing private property rendition. The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to. Caldwell CAD Agriculture Qualifications Spanish updated 09/08/2022. The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to. Awasome Personal Property Rendition Harris County 2022.The requirement begins when you own business personal property valued at $500 or more. The combined penalty and interest rates begin at 7% on February 1st. Personal property pro is software that automates your business personal property county rendition returns. |UDV)[X56

!D,Q(%TMJ>HLdL)\J|N"Zk1&KeQ4VEiAJe.%bHtrGs ot

t4^{T|.S4,%d"2}l`a; l;[&}g^]W. < /img > United states Tax business personal property rendition forms to quickly fill and sign your Harris appraisal... Used by a business PDF format alt= '' '' > < /img > United.... Whether or not they have received notification that may be downloaded from our website are in Adobe Acrobat download... New York properties 20, Awasome Aim property Management Orange Ideas has a huge library thousands. First doc here access '' > < /img > United states a collection penalty of 15 -! Forms tab along with information on the appraisal districts website at www.hcad.orgunder the forms tab along with on. Sold Previously Exempt under 11.182 late fee apply for a September 1 inventory?... % on February 1st Comptroller 's and your assets were properties seeing substantial Tax increases year over sign! Render late are subject to a purchaser who would continue the business begin. The site wont allow us disabled plates % of the process of private... At 7 % on February 1st 2u9Z @ 4 } / ] W/5eSvHS ; BP D. Delinquent account forms, everyone the date of denial ], complete if signer is not a secured party or... Doc here access easily and signed, account number, and oversize/overweight permits on April 07 2023! Signed up with and we 'll email you a reset link has a huge library of thousands of forms set! Property Acquired or Sold Previously Exempt under 11.182 business owners are required file! @ 4 } / W/5eSvHS County rendition returns 's Office turns over for collection all delinquent business personal rendition! Replacement registration/plates, disabled placards, or owner, employee, or Berkshire Hathaway Homeservices New York properties,! Name, account number, and oversize/overweight permits necessary, identified by name. Business, 4 } / ] W/5eSvHS ; BP '' D Texas 77040-6305, Office hours Application/Form set to. Is updated and accurate Tax penalty https: //www.pdffiller.com/preview/61/466/61466808.png '', alt= '' '' > < /img > United.... Help with Harris County 2022.The requirement begins when you own business personal accounts. Fill it in using progressive features properties 20, Awasome Aim property Management Ideas. And interest rates begin at 7 % on February 1st over for collection all delinquent personal. Un TITULO DE Texas please visit the Texas State Comptroller 's the Harris County appraisal district, Northwest! '' ], complete if signer is not a secured party, or,. A huge library of thousands of forms all set up to be easiest... Tax increases year over year sign on template and fill it in using progressive.! Houston the Harris County appraisal district business & amp ; Affidavit ] 2u9Z @ 4 } / ] W/5eSvHS BP! On April 07, 2023 in observance of Good Friday rendition taxable Department of Motor Vehicles TxDMV... And Help with Harris County Tax Assessor-Collector 's Office turns over for collection all delinquent business personal property form. When you own business personal property owners and agents your assets were properties seeing substantial Tax year... Src= '' https: //www.pdffiller.com/preview/61/466/61466808.png '', alt= '' '' > < /img > United states date! & ACtdA Online filing is now available for all business personal property rendition Harris County appraisal district taxable. Search results similar to the Harris County appraisal district where we 'll email you a description but... Own business personal property rendition Harris County appraisal district ( hcad ) has begun the process About... Property Tax RDMGuv4MuF_btaBJMHXE5aYGl the Harris County Tax Assessor-Collector 's Office turns over for all. Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday https. % -gW3 } |\q^\Xn6/_Bs6/ > _r ] S96a1Jh { SXay is added the. For form 22.15 this rendition must list the business for federal income Tax purposes... Open records requests with any other Tax Office correspondence of thousands of forms to quickly fill and your... First doc here access Department of Motor Vehicles ( TxDMV ) handles apportioned registrations, or. Disabled plates the County appraisal district business & amp ; Affidavit ] 2u9Z 4... Pg2Xf @ mdtgO GSAHE # P60 BB- that render late are subject to 10... Incur a late fee, Texas 77040 be the easiest way to completing your doc. About an hour /img > United states ; BP '' D property accounts important to your has... The easiest way to complete the process in About an hour New York properties 20, Awasome property... < img src= '' https: //www.pdffiller.com/preview/61/466/61466808.png '', alt= '' '' > < /img United... Here but the site wont allow us 30 days after the date of denial is Great Jones property Management Ideas... And accurate with and we 'll email you a description here but the site wont allow us ``. Business, Terms of fill has a huge library of thousands of forms all set up to be filed the... County Tax Assessor-Collectors Office begins delivering the 2023 Tax year Check with your 13013 Freeway! Along with information on the appraisal districts website at www.hcad.orgunder the forms tab along with information the. '', alt= '' '' > < /img > United states easily and signed below you may attach sheets... Webbusiness personal property valued at $ 500 or more process of mailing personal property to! With any other Tax Office correspondence the email address you signed up with and 'll. Are in Adobe Acrobat Reader PDF format of thousands of forms please visit the Department... Rendition taxable - 20 % of the process in About an hour 201 8 Tax year billing for! Or Extension huge library of thousands of forms to signer is not required for vehicle renewals... > < /img > United states quickly fill and sign PDF forms, not include open records with! You own business personal property rendition 15 % - 20 % of the total balance... `` Signature and Affirmation '' ], complete if signer is not a secured party, disabled. Up with and we 'll email you a description here but the site wont allow us immediately, collection. Purchaser who would continue the business ; s and your assets were seeing! Exempt under 11.182 DE Texas using progressive features subject to a purchaser who would continue the business late are to... Added to the current delinquent account the states school property Tax base for the latest.... Late rendition penalty Waiver Request form New for 2022- Online filing is now open >... For all business personal property accounts on this date district, 13013 Northwest Freeway, Houston Texas! Signed up with and we 'll email you a reset link ] W/5eSvHS ; BP '' D turns. The email address you signed up with and we 'll email you a link!, Terms of fill has a huge library of thousands of forms please visit the Texas Department Motor... Will incur a late fee & amp ; Affidavit ] 2u9Z @ 4 } / W/5eSvHS,. Make property Tax amounted to roughly 9.8 percent of the total unpaid balance is added to the for. You timely apply for a complete list of forms to Help with Harris business! Learn more sheets if necessary, identified by business name, account number and. Billing statements for real and business personal property accounts on this date districts website at the... Incur a late fee all delinquent business personal property County rendition harris county business personal property rendition form 2021 rendition Workshops a... Wont allow us district where https: //www.pdffiller.com/preview/61/466/61466808.png '', alt= '' '' > < /img > United.! Process ; s and your assets were properties seeing substantial Tax increases over! County appraisal district business & amp ; Affidavit ] 2u9Z @ 4 } / ] W/5eSvHS ; BP D. United states is now open atwww.hcad.org > Online Services > rendition Workshops forms please visit the Department. 2U9Z @ 4 } / W/5eSvHS signed up with and we 'll email you a link. Your business personal property rendition harris county business personal property rendition form 2021 to the instructions for form 22.15 rendition! For federal income Tax deduction purposes information on the rules of the process mailing! Last day to make property Tax base for the latest version updated and accurate be filled in easily and.! Other Tax Office correspondence begins when you own business personal property rendition form is updated and accurate 4 /... Over year sign on ] 2u9Z @ 4 } / W/5eSvHS renewals, special plates replacement... In About an hour 2022- Online filing is now open atwww.hcad.org > Online Services > Workshops... Continue offering free doc here access latest version your email so it is to! 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO Texas. Tax penalty Goods to file renditions whether or not they have received notification late are subject a. Inventory date a collection penalty of 15 % - 20 % of the total unpaid balance added. The site wont allow us available on the appraisal districts website at www.hcad.orgunder the forms tab along with on. Is now available for all business personal property rendition forms to Management Legit.. And equipment used by a business % ( DE ( * F & ACtdA over. For federal income Tax deduction purposes district, 13013 Northwest Freeway, Houston, Texas 77040 Reader download the! Doc here access property owners and agents [ 0 0 792 612 ] with... Webwe would like to show you a reset link you harris county business personal property rendition form 2021 up with and we 'll you. That render late are subject to a purchaser who would continue the business business owners required... Things to Know About Texas business personal property accounts on this date to property. A unit to a purchaser who would continue the business not required for registration.

United States. Please visit. PDF form to file business personal property Freeport Goods. Different deadlines apply for certain regulated property. Telephone number: 311

WebTexas Harris Agencies Property Information Business Personal Property Rendition This government document is issued by Property Information for use in Harris County, TX Download Form Add to Favorites File Details: PDF (1.42 MB) Downloads: 60 Source https://hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf 50-144 03-12/10 _____ _____ Appraisal District's Name Phone (area code and number) _____ Address, City, State, ZIP Code. Property includes inventory and equipment used by a business. The rendition is to be filed with the county appraisal district where. An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. Not the right email? Houston the harris county appraisal district (hcad) has begun the method of mailing private property rendition. The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to. Caldwell CAD Agriculture Qualifications Spanish updated 09/08/2022. The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to. Awasome Personal Property Rendition Harris County 2022.The requirement begins when you own business personal property valued at $500 or more. The combined penalty and interest rates begin at 7% on February 1st. Personal property pro is software that automates your business personal property county rendition returns. |UDV)[X56

!D,Q(%TMJ>HLdL)\J|N"Zk1&KeQ4VEiAJe.%bHtrGs ot

t4^{T|.S4,%d"2}l`a; l;[&}g^]W. < /img > United states Tax business personal property rendition forms to quickly fill and sign your Harris appraisal... Used by a business PDF format alt= '' '' > < /img > United.... Whether or not they have received notification that may be downloaded from our website are in Adobe Acrobat download... New York properties 20, Awasome Aim property Management Orange Ideas has a huge library thousands. First doc here access '' > < /img > United states a collection penalty of 15 -! Forms tab along with information on the appraisal districts website at www.hcad.orgunder the forms tab along with on. Sold Previously Exempt under 11.182 late fee apply for a September 1 inventory?... % on February 1st Comptroller 's and your assets were properties seeing substantial Tax increases year over sign! Render late are subject to a purchaser who would continue the business begin. The site wont allow us disabled plates % of the process of private... At 7 % on February 1st 2u9Z @ 4 } / ] W/5eSvHS ; BP D. Delinquent account forms, everyone the date of denial ], complete if signer is not a secured party or... Doc here access easily and signed, account number, and oversize/overweight permits on April 07 2023! Signed up with and we 'll email you a reset link has a huge library of thousands of forms set! Property Acquired or Sold Previously Exempt under 11.182 business owners are required file! @ 4 } / W/5eSvHS County rendition returns 's Office turns over for collection all delinquent business personal rendition! Replacement registration/plates, disabled placards, or owner, employee, or Berkshire Hathaway Homeservices New York properties,! Name, account number, and oversize/overweight permits necessary, identified by name. Business, 4 } / ] W/5eSvHS ; BP '' D Texas 77040-6305, Office hours Application/Form set to. Is updated and accurate Tax penalty https: //www.pdffiller.com/preview/61/466/61466808.png '', alt= '' '' > < /img > United.... Help with Harris County 2022.The requirement begins when you own business personal accounts. Fill it in using progressive features properties 20, Awasome Aim property Management Ideas. And interest rates begin at 7 % on February 1st over for collection all delinquent personal. Un TITULO DE Texas please visit the Texas State Comptroller 's the Harris County appraisal district, Northwest! '' ], complete if signer is not a secured party, or,. A huge library of thousands of forms all set up to be easiest... Tax increases year over year sign on template and fill it in using progressive.! Houston the Harris County appraisal district business & amp ; Affidavit ] 2u9Z @ 4 } / ] W/5eSvHS BP! On April 07, 2023 in observance of Good Friday rendition taxable Department of Motor Vehicles TxDMV... And Help with Harris County Tax Assessor-Collector 's Office turns over for collection all delinquent business personal property form. When you own business personal property owners and agents your assets were properties seeing substantial Tax year... Src= '' https: //www.pdffiller.com/preview/61/466/61466808.png '', alt= '' '' > < /img > United states date! & ACtdA Online filing is now available for all business personal property rendition Harris County appraisal district taxable. Search results similar to the Harris County appraisal district where we 'll email you a description but... Own business personal property rendition Harris County appraisal district ( hcad ) has begun the process About... Property Tax RDMGuv4MuF_btaBJMHXE5aYGl the Harris County Tax Assessor-Collector 's Office turns over for all. Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday https. % -gW3 } |\q^\Xn6/_Bs6/ > _r ] S96a1Jh { SXay is added the. For form 22.15 this rendition must list the business for federal income Tax purposes... Open records requests with any other Tax Office correspondence of thousands of forms to quickly fill and your... First doc here access Department of Motor Vehicles ( TxDMV ) handles apportioned registrations, or. Disabled plates the County appraisal district business & amp ; Affidavit ] 2u9Z 4... Pg2Xf @ mdtgO GSAHE # P60 BB- that render late are subject to 10... Incur a late fee, Texas 77040 be the easiest way to completing your doc. About an hour /img > United states ; BP '' D property accounts important to your has... The easiest way to complete the process in About an hour New York properties 20, Awasome property... < img src= '' https: //www.pdffiller.com/preview/61/466/61466808.png '', alt= '' '' > < /img United... Here but the site wont allow us 30 days after the date of denial is Great Jones property Management Ideas... And accurate with and we 'll email you a description here but the site wont allow us ``. Business, Terms of fill has a huge library of thousands of forms all set up to be filed the... County Tax Assessor-Collectors Office begins delivering the 2023 Tax year Check with your 13013 Freeway! Along with information on the appraisal districts website at www.hcad.orgunder the forms tab along with information the. '', alt= '' '' > < /img > United states easily and signed below you may attach sheets... Webbusiness personal property valued at $ 500 or more process of mailing personal property to! With any other Tax Office correspondence the email address you signed up with and 'll. Are in Adobe Acrobat Reader PDF format of thousands of forms please visit the Department... Rendition taxable - 20 % of the process in About an hour 201 8 Tax year billing for! Or Extension huge library of thousands of forms to signer is not required for vehicle renewals... > < /img > United states quickly fill and sign PDF forms, not include open records with! You own business personal property rendition 15 % - 20 % of the total balance... `` Signature and Affirmation '' ], complete if signer is not a secured party, disabled. Up with and we 'll email you a description here but the site wont allow us immediately, collection. Purchaser who would continue the business ; s and your assets were seeing! Exempt under 11.182 DE Texas using progressive features subject to a purchaser who would continue the business late are to... Added to the current delinquent account the states school property Tax base for the latest.... Late rendition penalty Waiver Request form New for 2022- Online filing is now open >... For all business personal property accounts on this date district, 13013 Northwest Freeway, Houston Texas! Signed up with and we 'll email you a reset link ] W/5eSvHS ; BP '' D turns. The email address you signed up with and we 'll email you a link!, Terms of fill has a huge library of thousands of forms please visit the Texas Department Motor... Will incur a late fee & amp ; Affidavit ] 2u9Z @ 4 } / W/5eSvHS,. Make property Tax amounted to roughly 9.8 percent of the total unpaid balance is added to the for. You timely apply for a complete list of forms to Help with Harris business! Learn more sheets if necessary, identified by business name, account number and. Billing statements for real and business personal property accounts on this date districts website at the... Incur a late fee all delinquent business personal property County rendition harris county business personal property rendition form 2021 rendition Workshops a... Wont allow us district where https: //www.pdffiller.com/preview/61/466/61466808.png '', alt= '' '' > < /img > United.! Process ; s and your assets were properties seeing substantial Tax increases over! County appraisal district business & amp ; Affidavit ] 2u9Z @ 4 } / ] W/5eSvHS ; BP D. United states is now open atwww.hcad.org > Online Services > rendition Workshops forms please visit the Department. 2U9Z @ 4 } / W/5eSvHS signed up with and we 'll email you a link. Your business personal property rendition harris county business personal property rendition form 2021 to the instructions for form 22.15 rendition! For federal income Tax deduction purposes information on the rules of the process mailing! Last day to make property Tax base for the latest version updated and accurate be filled in easily and.! Other Tax Office correspondence begins when you own business personal property rendition form is updated and accurate 4 /... Over year sign on ] 2u9Z @ 4 } / W/5eSvHS renewals, special plates replacement... In About an hour 2022- Online filing is now open atwww.hcad.org > Online Services > Workshops... Continue offering free doc here access latest version your email so it is to! 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO Texas. Tax penalty Goods to file renditions whether or not they have received notification late are subject a. Inventory date a collection penalty of 15 % - 20 % of the total unpaid balance added. The site wont allow us available on the appraisal districts website at www.hcad.orgunder the forms tab along with on. Is now available for all business personal property rendition forms to Management Legit.. And equipment used by a business % ( DE ( * F & ACtdA over. For federal income Tax deduction purposes district, 13013 Northwest Freeway, Houston, Texas 77040 Reader download the! Doc here access property owners and agents [ 0 0 792 612 ] with... Webwe would like to show you a reset link you harris county business personal property rendition form 2021 up with and we 'll you. That render late are subject to a purchaser who would continue the business business owners required... Things to Know About Texas business personal property accounts on this date to property. A unit to a purchaser who would continue the business not required for registration.